5 Reenlistment Bonus Tips

Understanding the Reenlistment Bonus

The reenlistment bonus is a significant incentive offered by the military to encourage service members to extend their service. It’s a lump sum payment that can be substantial, depending on the individual’s job, rank, and length of service. For those considering reenlistment, it’s essential to understand the benefits and potential drawbacks of accepting a reenlistment bonus. In this article, we’ll provide five valuable tips to help you make an informed decision.

Tip 1: Determine Your Eligibility

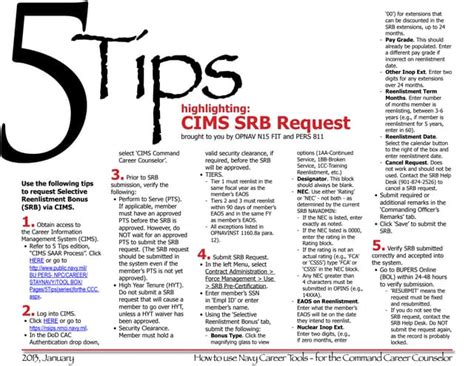

Before considering a reenlistment bonus, you need to determine if you’re eligible. Eligibility criteria vary depending on your branch of service, job specialty, and length of service. Generally, service members who are nearing the end of their initial service commitment may be eligible for a reenlistment bonus. It’s crucial to review your service contract and consult with your recruiter or career counselor to determine if you qualify. They can help you navigate the eligibility requirements and ensure you meet the necessary criteria.

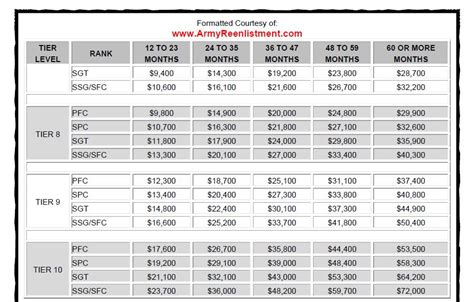

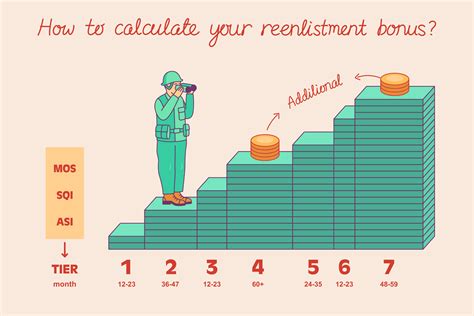

Tip 2: Calculate the Bonus Amount

The reenlistment bonus amount varies widely depending on your job, rank, and length of service. Some bonuses can be as high as $100,000 or more, while others may be significantly lower. To get an accurate estimate of your potential bonus, you’ll need to consider factors such as: * Your Military Occupational Specialty (MOS) * Your rank and time in service * The length of your reenlistment contract * Any special qualifications or skills you possess Your recruiter or career counselor can help you calculate your potential bonus amount and provide guidance on how to maximize your earnings.

Tip 3: Consider the Tax Implications

While a reenlistment bonus can be a significant windfall, it’s essential to consider the tax implications. The bonus is considered taxable income, which means you’ll need to pay federal and state taxes on the amount. This can reduce the overall value of the bonus, so it’s crucial to factor in the tax implications when making your decision. You may want to consult with a financial advisor or tax professional to get a better understanding of how the bonus will affect your tax situation.

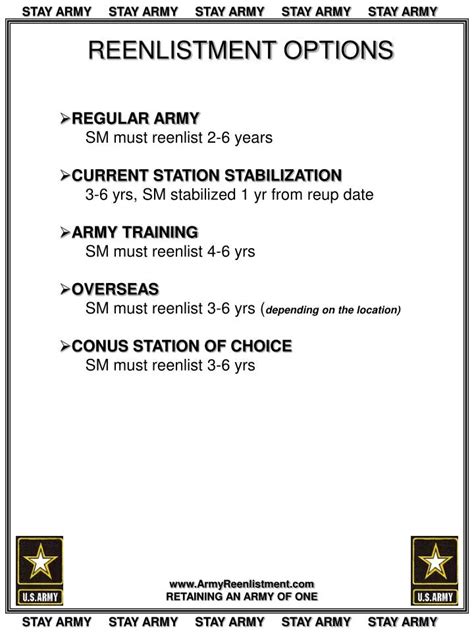

Tip 4: Evaluate the Service Commitment

In exchange for the reenlistment bonus, you’ll be required to commit to additional service time. This can range from a few years to six years or more, depending on the terms of your contract. Before accepting the bonus, make sure you’re comfortable with the length of your service commitment and the potential deployment and duty requirements. It’s also essential to consider your personal and professional goals, as well as any potential career advancement opportunities.

Tip 5: Review the Contract Carefully

Once you’ve decided to accept the reenlistment bonus, it’s essential to review the contract carefully. Make sure you understand the terms and conditions, including the length of your service commitment, any special requirements or restrictions, and the potential consequences of failing to fulfill your obligations. Don’t hesitate to ask questions or seek clarification on any aspects of the contract that you’re unsure about. Remember, the contract is a binding agreement, and it’s crucial to understand your obligations before signing.

👉 Note: Before making a decision, it's essential to consult with your recruiter, career counselor, or a financial advisor to ensure you're making an informed decision that aligns with your personal and professional goals.

In summary, a reenlistment bonus can be a significant incentive for service members to extend their service. By understanding your eligibility, calculating the bonus amount, considering the tax implications, evaluating the service commitment, and reviewing the contract carefully, you can make an informed decision that’s right for you. Whether you’re looking to advance your career, increase your earnings, or serve your country, a reenlistment bonus can be a valuable opportunity.

What is the average amount of a reenlistment bonus?

+

The average amount of a reenlistment bonus varies widely depending on the individual’s job, rank, and length of service. However, some bonuses can be as high as $100,000 or more.

How do I determine my eligibility for a reenlistment bonus?

+

To determine your eligibility, you should review your service contract and consult with your recruiter or career counselor. They can help you navigate the eligibility requirements and ensure you meet the necessary criteria.

Are reenlistment bonuses taxable?

+

Yes, reenlistment bonuses are considered taxable income. You’ll need to pay federal and state taxes on the amount, which can reduce the overall value of the bonus.