5 Ways to Repay Army Loans Easily

Understanding Army Loans and Repayment Options

Army loans, also known as military loans, are financial assistance programs designed for active-duty military personnel, veterans, and their families. These loans can help cover various expenses, such as emergency bills, debt consolidation, and large purchases. However, managing loan repayments can be challenging, especially for military personnel with limited financial resources. In this article, we will explore five ways to repay army loans easily, helping you navigate the repayment process with confidence.

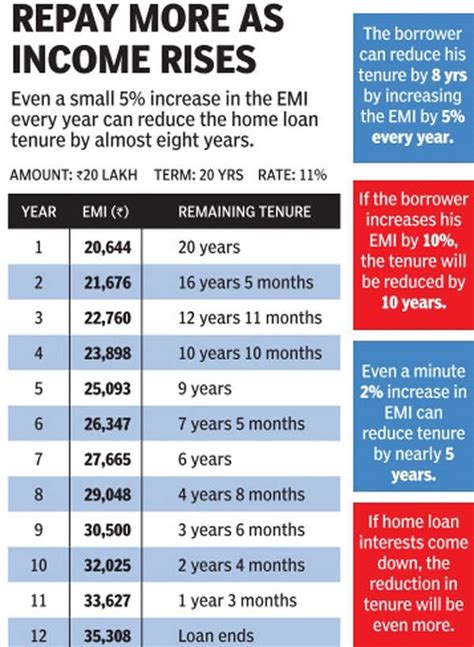

1. Create a Budget and Prioritize Debt Repayment

Before starting the loan repayment process, it’s essential to create a realistic budget that accounts for all your expenses, income, and debt obligations. Start by tracking your income and expenses to understand where your money is going. Make a list of all your debts, including the army loan, and prioritize them based on interest rates and urgency.

Budgeting Tips:

- Allocate 50% of your income towards necessary expenses like rent, utilities, and food

- Use 30% for discretionary spending, such as entertainment and hobbies

- Assign 20% for debt repayment, savings, and emergency funds

By prioritizing debt repayment, you’ll be able to tackle high-interest loans first and make timely payments on your army loan.

2. Consider a Debt Consolidation Loan

If you have multiple debts with high interest rates, a debt consolidation loan might be an attractive option. This type of loan allows you to combine multiple debts into a single loan with a lower interest rate and a longer repayment period.

Benefits of Debt Consolidation Loans:

- Simplified loan management with a single monthly payment

- Lower interest rates, resulting in reduced monthly payments

- Flexibility to choose a longer repayment period

However, be cautious when selecting a debt consolidation loan, as some may come with fees or stricter repayment terms.

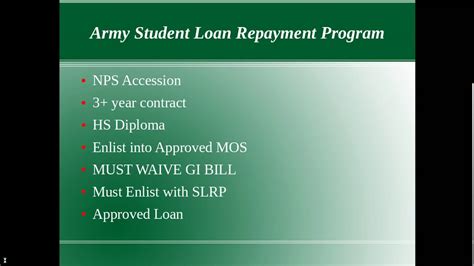

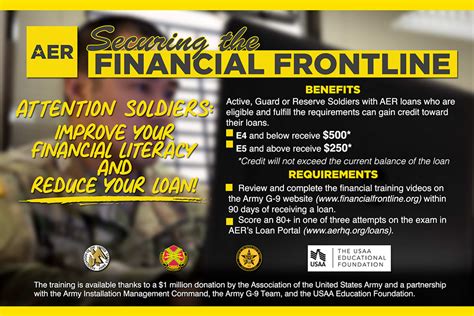

3. Take Advantage of Military Loan Forgiveness Programs

The military offers various loan forgiveness programs to help personnel manage their debt burden. These programs can provide significant relief, especially for those who have served in combat zones or have been injured in the line of duty.

Available Loan Forgiveness Programs:

- Public Service Loan Forgiveness (PSLF): Forgives remaining loan balance after 120 qualifying payments for public service workers, including military personnel

- Perkins Loan Cancellation: Offers partial or total loan forgiveness for borrowers who have served in the military or worked in public service

- Veterans’ Mortgage Life Insurance: Provides mortgage insurance coverage for eligible veterans

Explore these programs to determine if you qualify for loan forgiveness.

4. Use the Snowball Method for Repayment

The snowball method is a debt repayment strategy that involves paying off smaller loans first, while making minimum payments on larger loans. This approach can help build momentum and confidence in your repayment journey.

How the Snowball Method Works:

- List all your debts, starting with the smallest balance

- Make minimum payments on larger loans

- Allocate as much as possible towards the smallest loan balance

- Once the smallest loan is paid off, move to the next debt on the list

By focusing on smaller loans first, you’ll be able to eliminate multiple debts quickly, freeing up more funds for the larger loans.

5. Automate Your Payments

To ensure timely payments, consider automating your loan repayments. Set up automatic transfers from your checking account to your loan account, either through your bank’s online platform or the lender’s website.

Benefits of Automated Payments:

- Reduced risk of late fees and penalties

- Increased likelihood of on-time payments

- Simplified loan management with less manual intervention

By automating your payments, you’ll be able to stay on track with your loan repayment schedule and avoid unnecessary fees.

📝 Note: Before automating payments, ensure you have sufficient funds in your account to avoid overdraft fees.

In Conclusion

Repaying army loans requires a strategic approach, but with the right plan and resources, you can manage your debt effectively. By creating a budget, considering debt consolidation loans, taking advantage of military loan forgiveness programs, using the snowball method, and automating your payments, you’ll be well on your way to repaying your army loan with ease.

What is the typical interest rate for army loans?

+

Interest rates for army loans vary depending on the lender and loan terms. However, they are often lower than commercial loans, ranging from 6% to 12% APR.

Can I repay my army loan early without penalty?

+

Check your loan agreement to see if there are any prepayment penalties. Some lenders may charge a fee for early repayment, while others may allow penalty-free early repayment.

Are there any tax benefits for repaying army loans?

+

Consult with a tax professional to determine if you qualify for any tax deductions or credits related to your army loan repayments.