Are Bonuses Taxed

Understanding Taxation on Bonuses

When it comes to receiving bonuses, one of the most common questions employees have is whether these additional payments are taxed. The answer to this question can vary depending on the country, state, or region you are in, as well as the type of bonus and the tax laws that apply. In this article, we will delve into the world of bonus taxation, exploring how bonuses are taxed, the different types of bonuses, and what employees can expect when it comes to their take-home pay.

How Bonuses Are Taxed

Bonuses are generally considered supplemental wages, which are subject to taxation. The tax rate applied to bonuses can depend on several factors, including the amount of the bonus, the employee’s regular income, and the tax laws in their jurisdiction. In many countries, bonuses are taxed at a flat rate or through a percentage method, which can result in a higher tax rate than regular income. This is because bonuses are often considered a lump sum and may push the employee into a higher tax bracket.

Types of Bonuses and Their Tax Implications

There are various types of bonuses that employers may offer, each with its own tax implications: - Signing Bonuses: These are offered to new employees as an incentive to join the company. Signing bonuses are taxed as supplemental income. - Performance Bonuses: Given for achieving specific performance goals, these bonuses are also taxed as supplemental income. - Holiday Bonuses: Some employers give bonuses around holidays as a gesture of appreciation. These are taxed in the same manner as other bonuses. - Retention Bonuses: Designed to keep valuable employees from leaving, retention bonuses are subject to taxation as well.

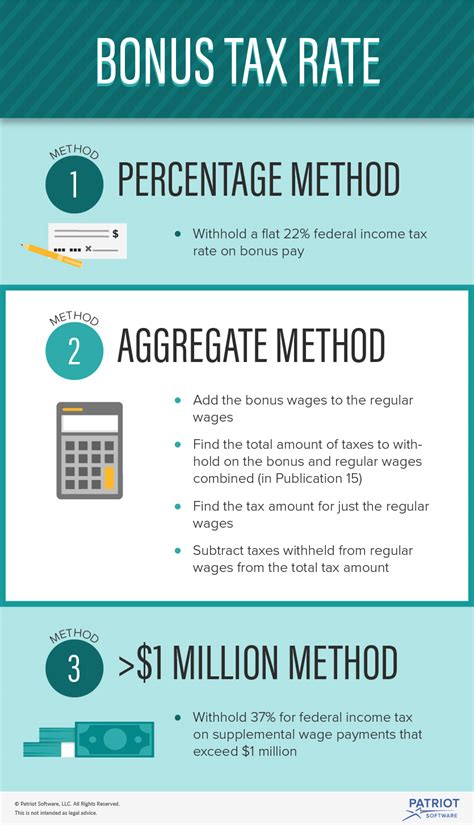

Tax Calculation Methods

There are primarily two methods used to calculate taxes on bonuses: - The Aggregate Method: Here, the bonus is added to the employee’s regular wages and taxed accordingly. This can sometimes result in a higher tax rate if the combined income pushes the employee into a higher tax bracket. - The Flat Rate Method: A flat percentage (often 25% in the United States, but this can vary by country) is applied to the bonus amount. This method is simpler but can be less accurate in terms of the employee’s actual tax liability.

Impact on Take-Home Pay

The taxation of bonuses can significantly impact an employee’s take-home pay. For instance, if an employee is expecting a 1,000 bonus and 25% of it goes to taxes, they will only receive 750. Understanding how bonuses are taxed can help employees better manage their finances and not be surprised when their bonus check is less than expected.

Strategies for Managing Bonus Taxes

While employees cannot avoid paying taxes on their bonuses, there are strategies to minimize the tax impact: - Tax Planning: Understanding how bonuses will be taxed can help in planning for the tax year. Employees might consider adjusting their withholding or deductions to minimize their tax liability. - Deferred Compensation: Some employers offer deferred compensation plans, where the bonus is paid out over time rather than all at once. This can help spread out the tax liability. - Retirement Contributions: Increasing contributions to tax-deferred retirement accounts can help reduce taxable income, potentially lowering the tax rate applied to bonuses.

📝 Note: It's essential to consult with a tax professional to understand how bonuses are taxed in your specific situation, as tax laws and regulations can change and vary greatly by location.

Conclusion and Final Thoughts

In summary, bonuses are indeed subject to taxation, and the method of taxation can vary. Understanding how bonuses are taxed and the strategies available to manage the tax impact can help employees make the most of their compensation packages. Whether you’re an employer looking to structure bonuses effectively or an employee seeking to maximize your take-home pay, being informed about bonus taxation is crucial. By considering the tax implications of bonuses, individuals can better plan their finances and make informed decisions about their compensation.

Are all types of bonuses taxed the same way?

+

No, the tax treatment of bonuses can vary depending on the type of bonus, the country, and the tax laws that apply. For instance, some bonuses might be taxed at a flat rate, while others could be subject to progressive taxation based on the employee’s income level.

Can employees negotiate how their bonuses are taxed?

+

While employees cannot negotiate the tax rate applied to their bonuses, they can discuss with their employer the timing and structure of bonus payments to potentially minimize tax liabilities. For example, deferred compensation plans might be an option in some cases.

Do tax laws regarding bonuses change often?

+

Yes, tax laws and regulations can change, and these changes can impact how bonuses are taxed. It’s essential for both employers and employees to stay informed about current tax laws and any updates that might affect bonus taxation.