Military

5 Ways Stop War Taxes

Introduction to War Tax Resistance

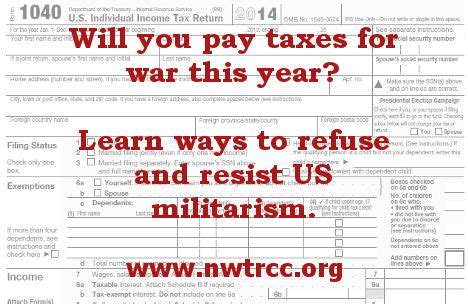

War tax resistance is the practice of refusing to pay taxes that are used to fund war and the military. This practice has been around for centuries and has been used by individuals and groups as a form of protest against war and violence. There are several ways to resist war taxes, and in this article, we will explore five of them.

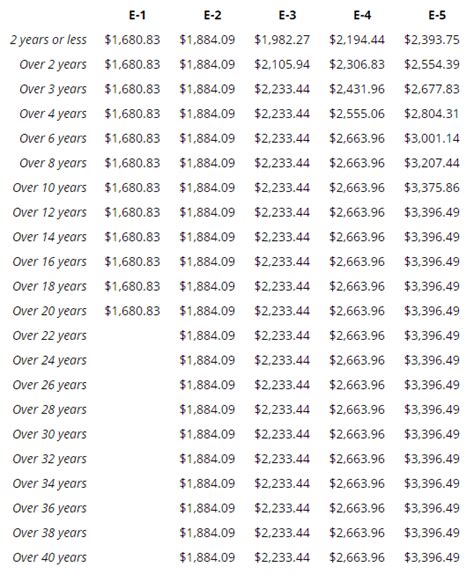

Understanding War Taxes

Before we dive into the ways to stop war taxes, it’s essential to understand what war taxes are and how they are used. War taxes are the portion of our taxes that are allocated to fund the military and war efforts. In the United States, for example, a significant portion of the federal budget is dedicated to military spending. By paying taxes, individuals are inadvertently contributing to the funding of war and violence.

5 Ways to Stop War Taxes

Here are five ways to stop war taxes: * Reduce Your Tax Liability: One way to reduce your contribution to war taxes is to reduce your tax liability. This can be done by taking advantage of tax deductions and credits, such as charitable donations or home office deductions. * Divest from War-Related Investments: Another way to stop war taxes is to divest from investments that are related to war and the military. This can include stocks in defense contractors or other companies that profit from war. * Participate in Tax Resistance Programs: There are several tax resistance programs available that allow individuals to redirect their tax dollars to peaceful purposes. For example, the War Tax Resistance program allows individuals to refuse to pay a portion of their taxes and instead donate that amount to a peaceful cause. * Support Legislative Changes: Individuals can also support legislative changes that aim to reduce military spending and allocate more funds to peaceful purposes. This can be done by contacting representatives, signing petitions, and participating in advocacy campaigns. * Educate Yourself and Others: Finally, educating oneself and others about the issue of war taxes is crucial in creating a movement to stop war taxes. By spreading awareness and building a community of like-minded individuals, we can work together to create a more peaceful and just world.

Benefits of War Tax Resistance

War tax resistance has several benefits, including: * Reduced Contribution to War: By resisting war taxes, individuals can reduce their contribution to war and violence. * Increased Funding for Peaceful Purposes: By redirecting tax dollars to peaceful purposes, individuals can increase funding for causes that promote peace and justice. * Raise Awareness: War tax resistance can also raise awareness about the issue of war taxes and the need for more peaceful and just policies. * Build Community: Finally, war tax resistance can help build a community of like-minded individuals who are committed to creating a more peaceful and just world.

Challenges of War Tax Resistance

While war tax resistance can be an effective way to promote peace and justice, it also comes with several challenges, including: * Legal Consequences: Refusing to pay taxes can result in legal consequences, such as fines and penalties. * Social Consequences: War tax resistance can also result in social consequences, such as ostracism and criticism from others. * Financial Consequences: Finally, war tax resistance can result in financial consequences, such as reduced income or assets.

💡 Note: It's essential to carefully consider the potential consequences of war tax resistance before making a decision.

Conclusion and Final Thoughts

In conclusion, war tax resistance is a powerful way to promote peace and justice. By reducing our contribution to war taxes, divesting from war-related investments, participating in tax resistance programs, supporting legislative changes, and educating ourselves and others, we can work together to create a more peaceful and just world. While war tax resistance comes with several challenges, the benefits of promoting peace and justice make it a worthwhile endeavor.

What is war tax resistance?

+

War tax resistance is the practice of refusing to pay taxes that are used to fund war and the military.

How can I reduce my contribution to war taxes?

+

You can reduce your contribution to war taxes by reducing your tax liability, divesting from war-related investments, participating in tax resistance programs, supporting legislative changes, and educating yourself and others.

What are the benefits of war tax resistance?

+

The benefits of war tax resistance include reduced contribution to war, increased funding for peaceful purposes, raising awareness, and building a community of like-minded individuals.