5 Texas Payroll Tips

Understanding Texas Payroll: An Overview

Texas, known for its thriving economy and diverse workforce, presents a unique set of challenges and opportunities for businesses handling payroll. From compliance with state and federal laws to managing the intricacies of payroll processing, employers must be well-informed to navigate the complexities of Texas payroll effectively. This guide aims to provide insights and practical tips for managing payroll in Texas, ensuring that businesses can focus on growth and development while maintaining compliance and employee satisfaction.

Tip 1: Compliance with Texas and Federal Laws

Compliance is a cornerstone of payroll management. Employers in Texas must adhere to both federal and state laws. Federal laws dictate minimum wage, overtime pay, and record-keeping requirements, among other things. Meanwhile, Texas state laws may offer additional protections or requirements, such as those related to child support withholding or the payment of wages upon termination. It’s crucial for businesses to stay updated on these laws to avoid penalties and legal issues. Utilizing payroll software that is compliant with both federal and state regulations can significantly simplify this process.

Tip 2: Accurate Classification of Employees

The classification of workers as either employees or independent contractors is a critical aspect of payroll management in Texas. Misclassification can lead to severe penalties, including back pay, fines, and legal fees. Employers must understand the distinction between these categories, as defined by the IRS and Texas state laws. Generally, employees are entitled to benefits, minimum wage, and overtime pay, whereas independent contractors are not. Conducting audits or seeking professional advice can help ensure that all workers are correctly classified.

Tip 3: Managing Payroll Taxes

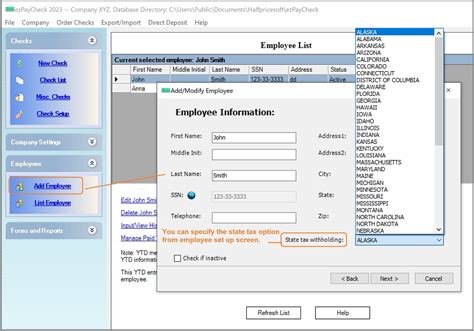

Payroll taxes in Texas include federal income taxes, Social Security taxes, and Medicare taxes, which are withheld from employees’ wages. Employers must also pay their share of Social Security and Medicare taxes and may be subject to federal and state unemployment taxes. Correct calculation and timely payment of these taxes are essential to avoid interest and penalties. Employers can use payroll software to streamline the calculation and payment process, ensuring compliance with all tax requirements.

Tip 4: Implementing Efficient Payroll Processing

Efficient payroll processing is vital for maintaining employee morale and ensuring compliance with labor laws. This includes: - Timely payment of wages and benefits. - Accurate record-keeping, including hours worked, pay rates, and deductions. - Transparent communication with employees regarding their pay and benefits. Utilizing payroll software can automate many of these tasks, reducing the risk of errors and improving the overall efficiency of the payroll process.

Tip 5: Training and Support for Payroll Staff

Finally, providing ongoing training and support for payroll staff is essential. Payroll laws and regulations are subject to change, and staying informed is crucial for compliance. Training should cover not only the legal aspects of payroll management but also the use of payroll software and best practices for record-keeping and employee communication. Investing in the education and support of payroll staff can prevent costly mistakes and improve the overall management of payroll in Texas.

| Payroll Aspect | Key Considerations |

|---|---|

| Compliance | Federal and Texas state laws, including minimum wage, overtime, and record-keeping. |

| Employee Classification | Distinguishing between employees and independent contractors to avoid misclassification. |

| Payroll Taxes | Withholding, calculation, and payment of federal and state taxes. |

| Efficient Processing | Timely payment, accurate record-keeping, and transparent communication. |

| Staff Training | Ongoing education on payroll laws, software, and best practices. |

📝 Note: Regularly reviewing and updating payroll processes and knowledge is crucial for maintaining compliance and efficiency in payroll management.

In summary, managing payroll in Texas requires a deep understanding of federal and state laws, accurate employee classification, efficient processing, and ongoing training for payroll staff. By following these tips and staying informed about changes in payroll regulations, businesses in Texas can ensure compliance, improve efficiency, and foster a positive work environment. This not only protects the business from potential legal and financial repercussions but also contributes to the well-being and satisfaction of its employees, ultimately driving business success and growth in the Lone Star State.

What are the key federal laws that affect payroll in Texas?

+

Key federal laws include the Fair Labor Standards Act (FLSA), which governs minimum wage, overtime pay, and record-keeping, among other aspects.

How do I correctly classify workers as employees or independent contractors in Texas?

+

Correct classification depends on the nature of the work, control over the worker, and the permanency of the relationship. The IRS and Texas state laws provide guidelines and tests to help determine the appropriate classification.

What payroll software features should I look for to ensure compliance and efficiency in Texas?

+

Look for software that automatically calculates taxes, tracks hours and pay, and generates compliance reports. Additionally, consider software that offers training and support for payroll staff and integrates with other HR systems.