E3 Visa Holder's Guide to Annual Income in USA

Introduction to E3 Visa and Annual Income in the USA

As an E3 visa holder, navigating the complexities of annual income in the United States can be overwhelming. The E3 visa is a non-immigrant visa specifically designed for Australian citizens to work in the United States in a specialty occupation. Understanding the annual income requirements and how to maintain your visa status is crucial to ensure a smooth and successful stay in the USA.

Understanding the E3 Visa Requirements

To qualify for an E3 visa, you must meet specific requirements, including:

- Being an Australian citizen

- Having a job offer in the USA for a specialty occupation

- Meeting the educational and qualifications requirements for the job

- Obtaining a Labor Condition Application (LCA) from the US Department of Labor

Annual Income Requirements for E3 Visa Holders

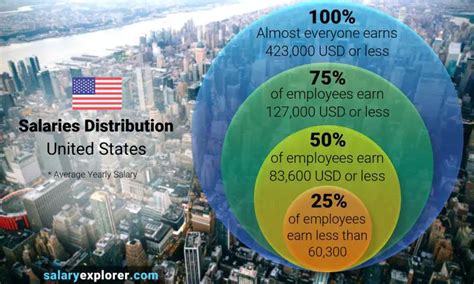

The annual income requirements for E3 visa holders vary depending on the occupation, location, and employer. However, the US Department of Labor requires that E3 visa holders be paid the prevailing wage for their occupation and location.

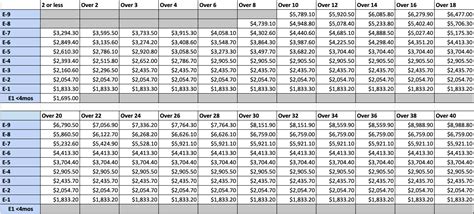

Prevailing Wage Rates

The prevailing wage rate is the minimum wage that employers must pay their employees, including E3 visa holders. The rates vary depending on the occupation, location, and level of experience. You can check the prevailing wage rates on the US Department of Labor’s website.

Salary Requirements

While there is no specific annual income requirement for E3 visa holders, you must be paid a salary that meets the prevailing wage rate for your occupation and location. Additionally, your salary must be paid in accordance with US labor laws, including the Fair Labor Standards Act (FLSA).

Tax Implications

As an E3 visa holder, you are considered a non-resident alien for tax purposes. You will be required to file a US tax return and pay taxes on your income. You may also be eligible for tax deductions and credits, depending on your individual circumstances.

Social Security and Medicare Taxes

As an E3 visa holder, you are exempt from paying Social Security and Medicare taxes for the first two years of your stay in the USA. After two years, you will be required to pay these taxes.

Maintaining Your E3 Visa Status

To maintain your E3 visa status, you must comply with the terms and conditions of your visa. This includes:

- Working for the employer and in the occupation specified on your visa

- Maintaining a valid passport

- Not engaging in unauthorized work or activities

- Complying with US labor laws and regulations

Annual Income and Visa Renewal

When renewing your E3 visa, you will be required to demonstrate that you have maintained a valid income source and complied with the terms and conditions of your visa. This may include providing documentation of your annual income, tax returns, and other financial records.

Additional Tips and Considerations

- Keep accurate records: Keep accurate records of your income, tax returns, and other financial documents to ensure you can demonstrate compliance with the terms and conditions of your visa.

- Consult a tax professional: Consult a tax professional to ensure you are meeting your tax obligations and taking advantage of available deductions and credits.

- Understand your employment contract: Understand the terms and conditions of your employment contract, including your salary, benefits, and any requirements for maintaining your visa status.

📝 Note: This guide is for informational purposes only and should not be considered as professional advice. Consult the US Department of Labor and other relevant authorities for specific guidance on annual income requirements and E3 visa regulations.

Conclusion

As an E3 visa holder, understanding the annual income requirements and maintaining your visa status is crucial to ensuring a successful stay in the USA. By following the guidelines outlined in this guide, you can ensure compliance with the terms and conditions of your visa and make the most of your time in the USA.

What is the prevailing wage rate for E3 visa holders?

+

The prevailing wage rate varies depending on the occupation, location, and level of experience. You can check the prevailing wage rates on the US Department of Labor’s website.

Do E3 visa holders pay Social Security and Medicare taxes?

+

As an E3 visa holder, you are exempt from paying Social Security and Medicare taxes for the first two years of your stay in the USA. After two years, you will be required to pay these taxes.

What are the tax implications for E3 visa holders?

+

As an E3 visa holder, you are considered a non-resident alien for tax purposes. You will be required to file a US tax return and pay taxes on your income. You may also be eligible for tax deductions and credits, depending on your individual circumstances.