Free Adding Money Worksheets for Kids

In today's digital age, where financial literacy is more crucial than ever, the education of young children in money management starts at an elementary level. Introducing children to the concept of money through educational tools can set a strong foundation for their financial acumen. One effective method is the use of free money worksheets for kids, designed to make learning about money not only informative but also engaging. This article will explore why these worksheets are beneficial, how they can be incorporated into learning, and provide some practical examples for parents and educators.

Why Use Money Worksheets?

- Builds Basic Money Skills: Worksheets help children understand and work with different coin and note values, fostering a practical sense of money.

- Encourages Practical Application: Through various scenarios and problems, kids learn to apply their knowledge in real-life contexts.

- Develops Math Skills: Counting, adding, and subtracting money provides a context for practicing arithmetic.

- Fun Learning: By incorporating games, puzzles, and activities, these worksheets transform learning into an interactive and enjoyable experience.

Key Areas of Money Learning

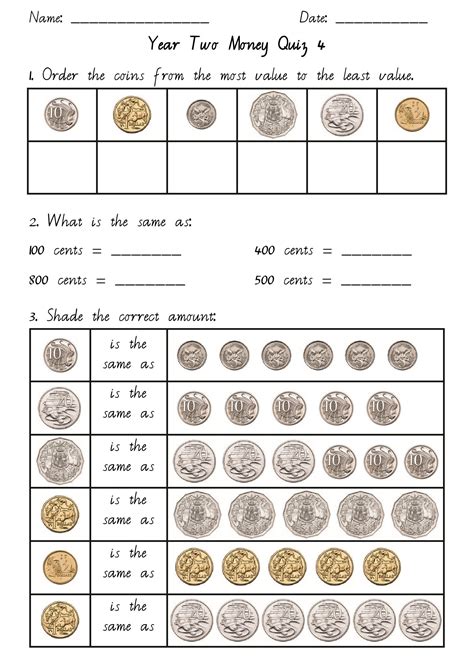

1. Coin and Note Recognition

Before children can add money, they must first recognize different coins and notes. Worksheets that feature colorful illustrations of currency can:

- Introduce the names and values of coins and notes.

- Encourage visual discrimination skills by asking children to match coins to their values.

💡 Note: Start with larger values like dollars or euros, then move to cents or smaller coins to facilitate a smoother learning curve.

2. Basic Money Transactions

Worksheets here would simulate simple transactions, helping kids to:

- Learn how to count money given and change received.

- Understand the concept of ‘spending’ versus ‘saving’.

3. Addition and Subtraction

This is the core of financial arithmetic:

- Adding up the cost of multiple items.

- Subtracting to find change from a given amount.

Incorporating Money Worksheets into Learning

Integrating into Daily Life

Worksheets can be integrated into children’s daily routines:

- Allowance Management: Use worksheets to teach children how to allocate their allowance for various expenses.

- Shopping Trips: Before going shopping, have kids prepare with worksheets that estimate costs or check if they have enough money.

Classroom Activities

In a classroom setting:

- Group Activities: Create group work or pair children up for role-playing scenarios involving money transactions.

- Themed Projects: Organize projects like setting up a classroom store or a lemonade stand to apply money management principles practically.

Example Worksheets for Money Addition

Worksheet 1: Coin Addition

This worksheet can include a table for:

| Coins | Value | Total |

|---|---|---|

| 3 Quarters | 0.75</td> <td>2.25 | |

| 4 Dimes | 0.40</td> <td>1.40 | |

| 2 Nickels | 0.10</td> <td>0.20 |

Worksheet 2: Change Calculation

- Scenario: A child buys a candy bar for 1.25 and gives a 5 bill. How much change should they receive?

Assessing the Benefits

By utilizing these money worksheets:

- Children gain confidence in handling and understanding money.

- They begin to understand the importance of budgeting, saving, and making informed financial decisions.

However, it's essential to balance the learning with practical experience. Money worksheets are a stepping stone to real-life financial interactions, where children can see the tangible results of their learning.

To wrap up, incorporating free money worksheets for kids into education provides numerous benefits. From developing basic arithmetic skills to fostering financial literacy, these tools can help pave the way for financially savvy future generations. Parents and educators should explore these resources, adapting them to fit the child's age and learning pace. The journey to financial independence starts with these small but significant steps. In this way, we can equip our children with the tools they need to thrive in an increasingly financial-centric world.

At what age should kids start learning about money?

+

Children can begin to grasp basic money concepts as early as age 5. However, formal learning through worksheets might be more beneficial around 6-7 years old when they start understanding basic arithmetic.

Are there digital versions of these worksheets?

+

Yes, many educational websites offer printable PDF versions or interactive digital money worksheets for kids, providing a variety of activities from coin recognition to complex transactions.

How can I make money worksheets more engaging?

+

Engagement can be enhanced by incorporating elements of play, such as:

- Using real or play money in activities.

- Creating scenarios where children can ‘buy’ items or ‘earn’ money for completing tasks.

- Incorporating puzzles, mazes, or stories that involve money-related challenges.