AARP Budget Worksheet: Simplify Your Financial Planning

If you're nearing retirement age or already enjoying your golden years, simplifying your financial planning can significantly enhance your peace of mind. Managing finances becomes more critical as your income and expenditures shift. This detailed guide will explore how to use the AARP Budget Worksheet to streamline your financial planning process. We'll cover what the worksheet is, how to utilize it effectively, and why it's particularly beneficial for seniors.

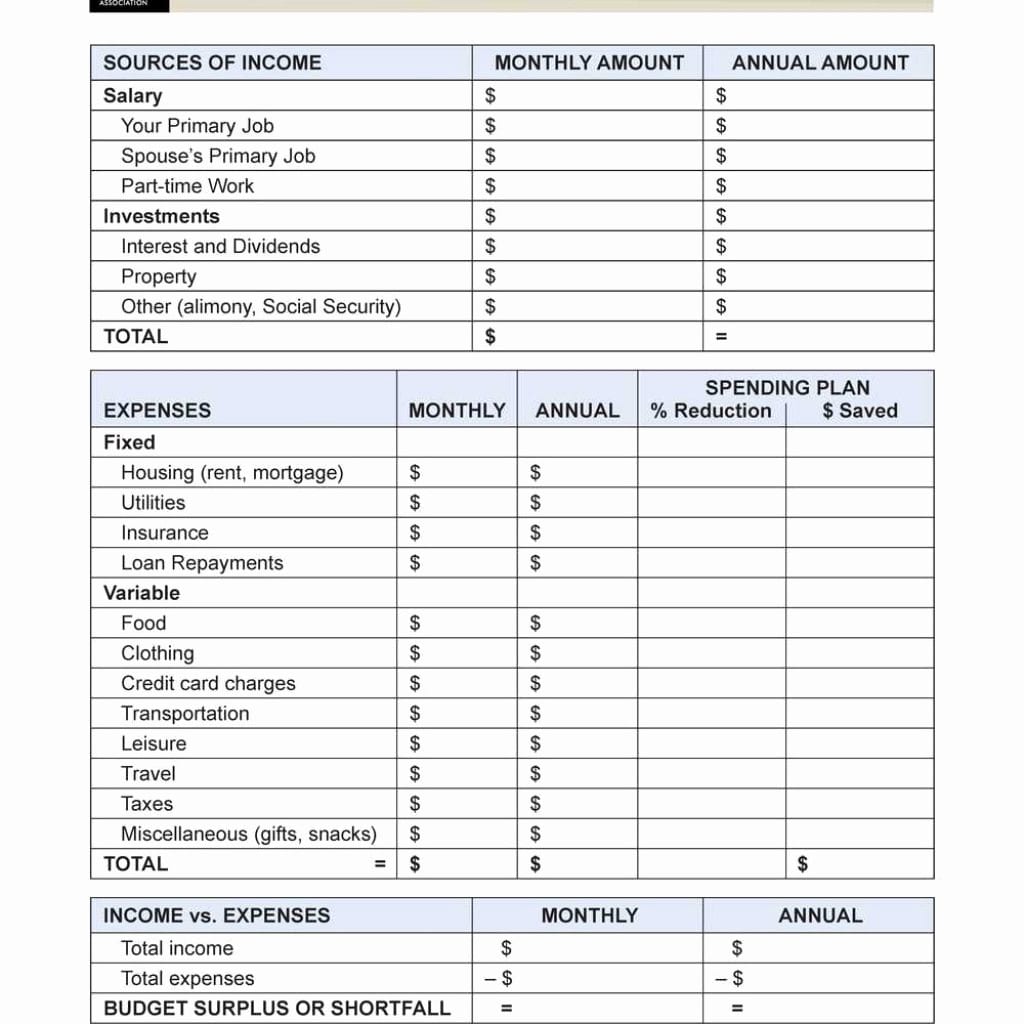

Understanding the AARP Budget Worksheet

The AARP Budget Worksheet is a comprehensive tool designed to help seniors and pre-retirees manage their finances. Here’s what makes it unique:

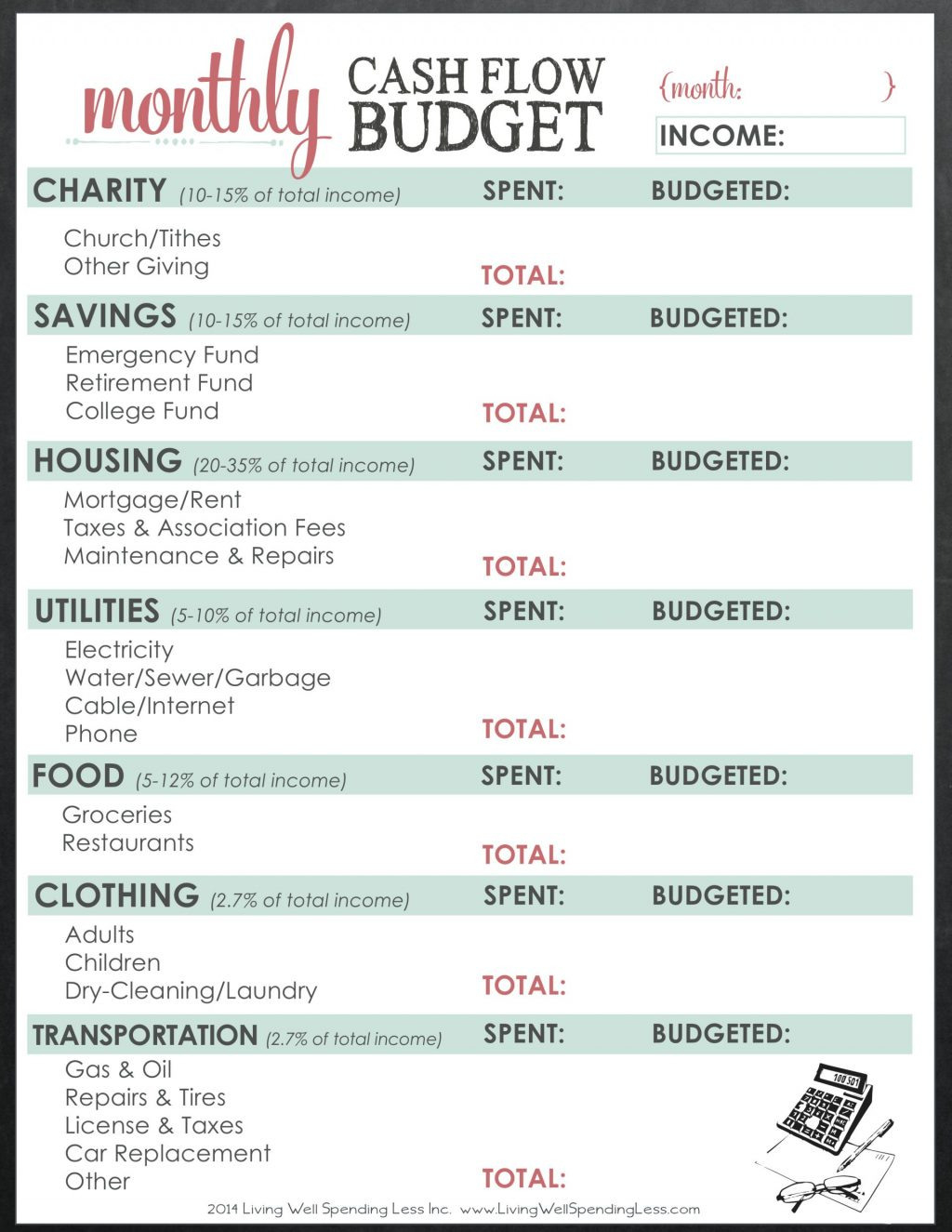

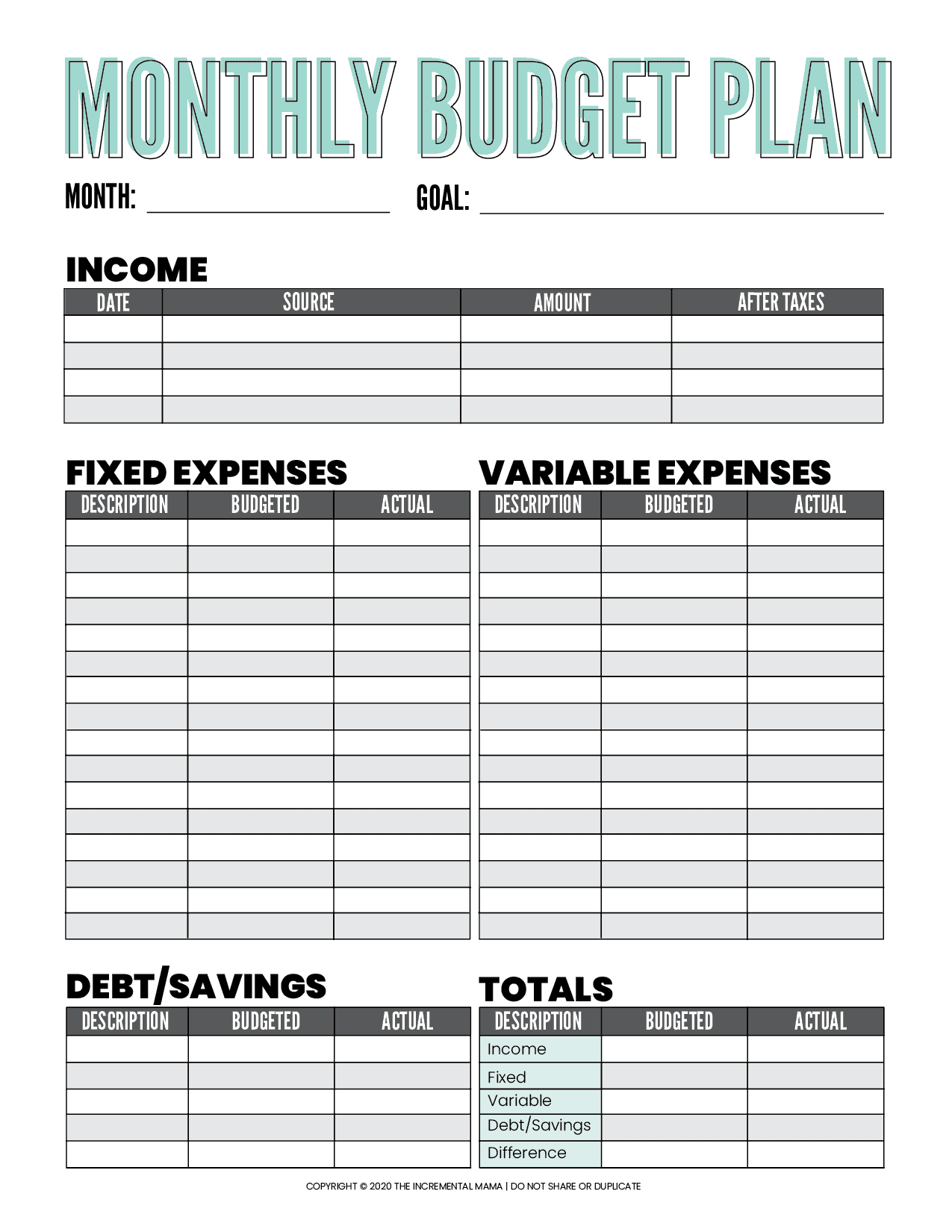

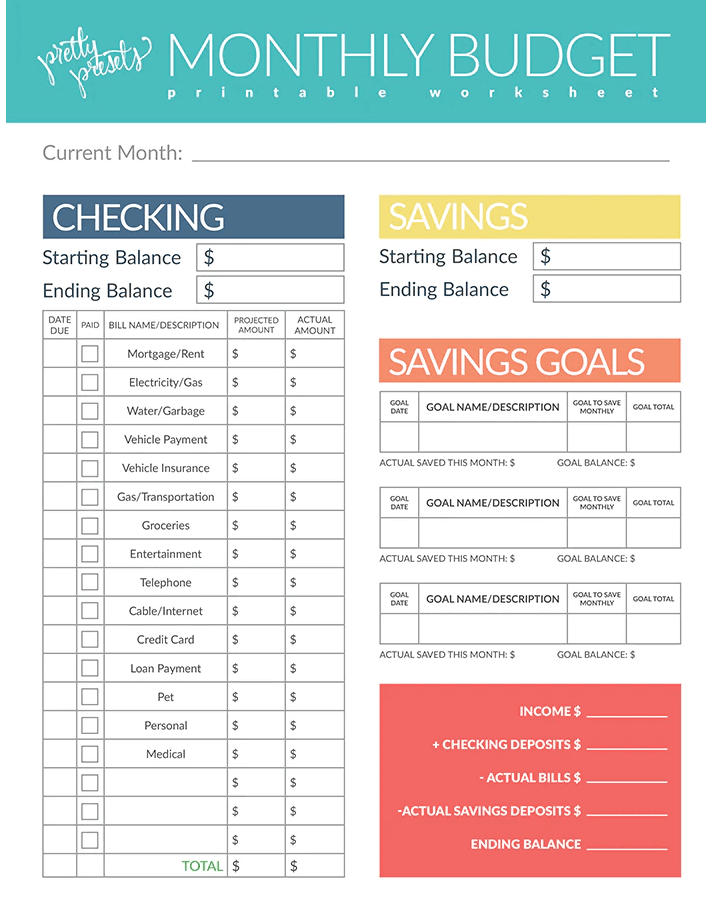

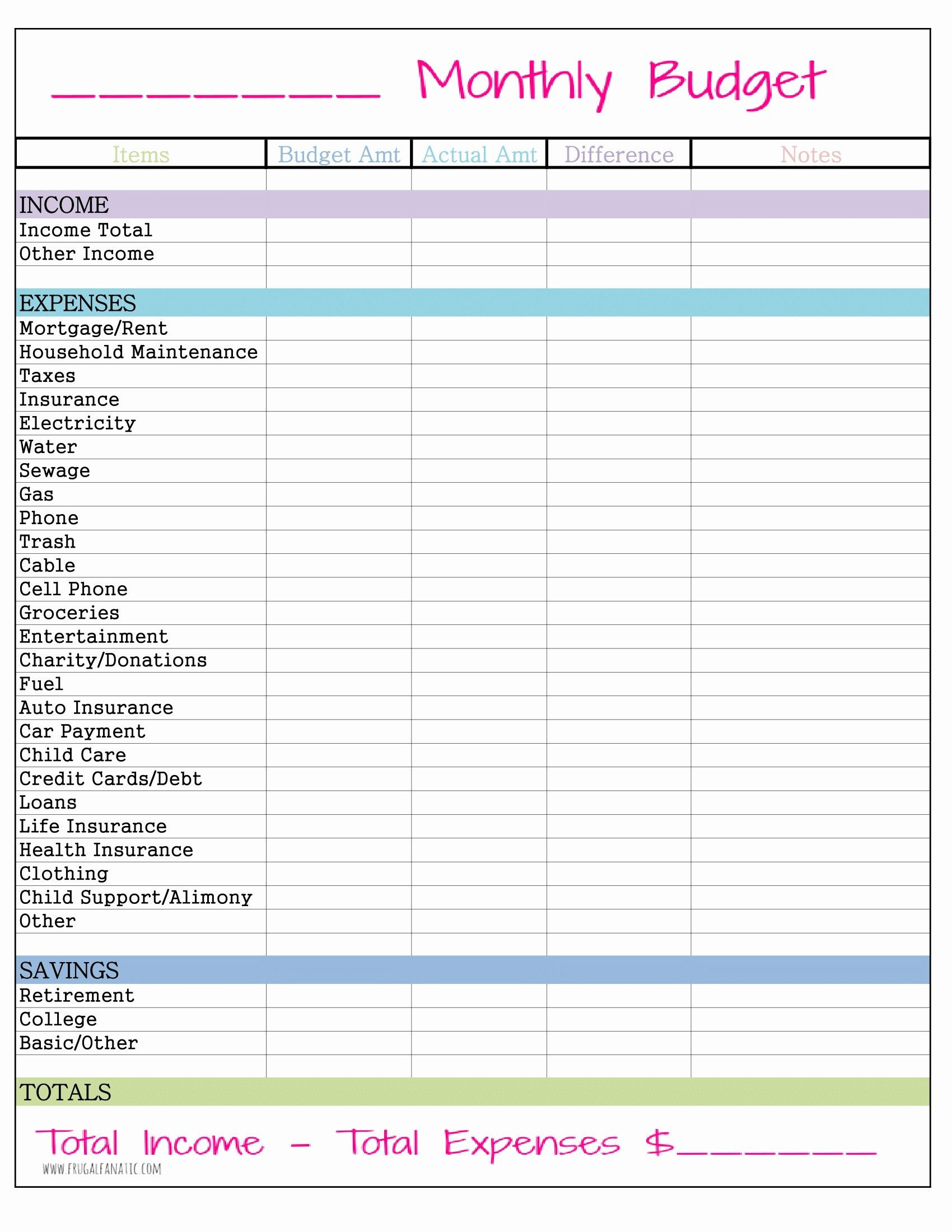

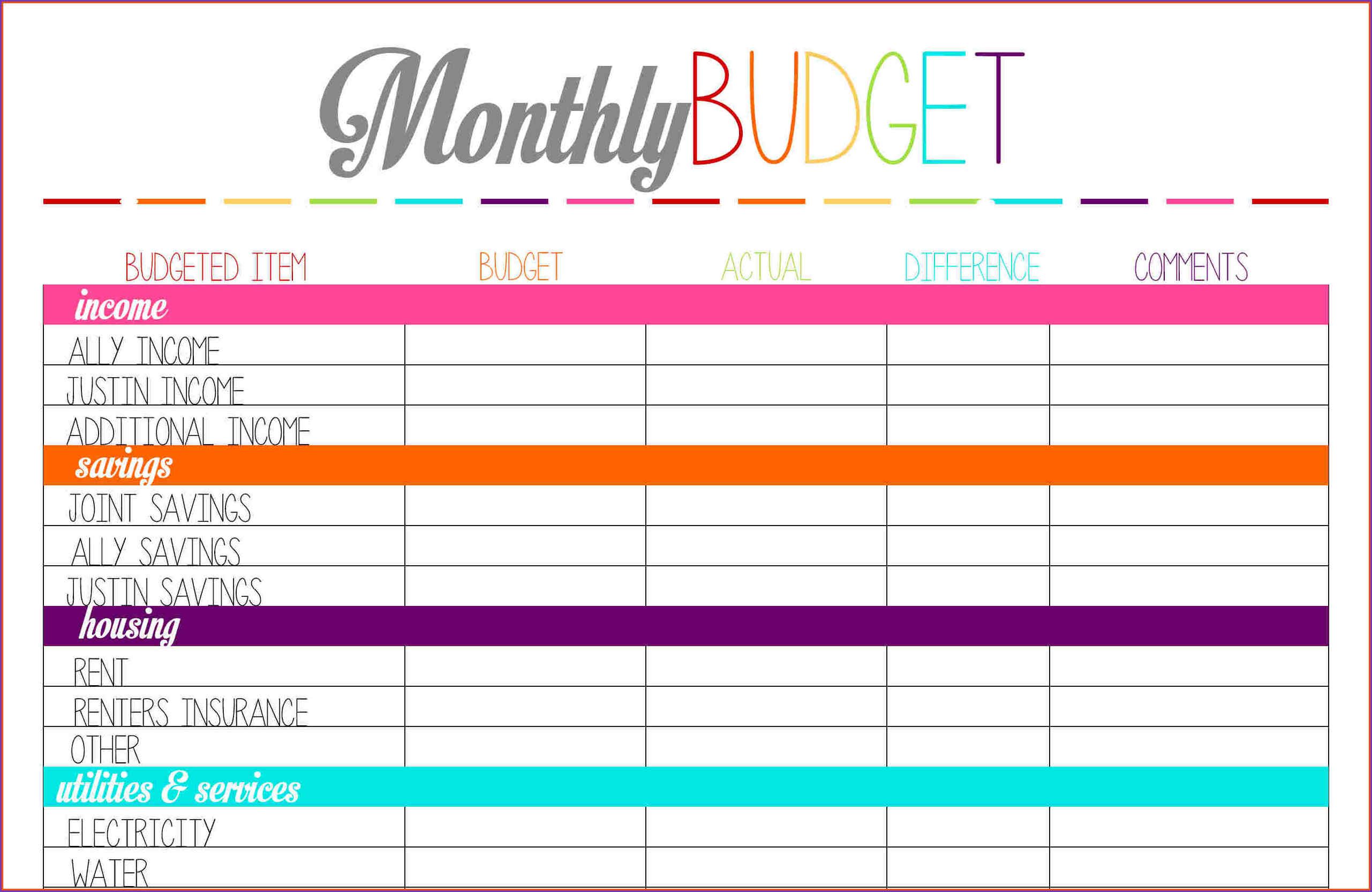

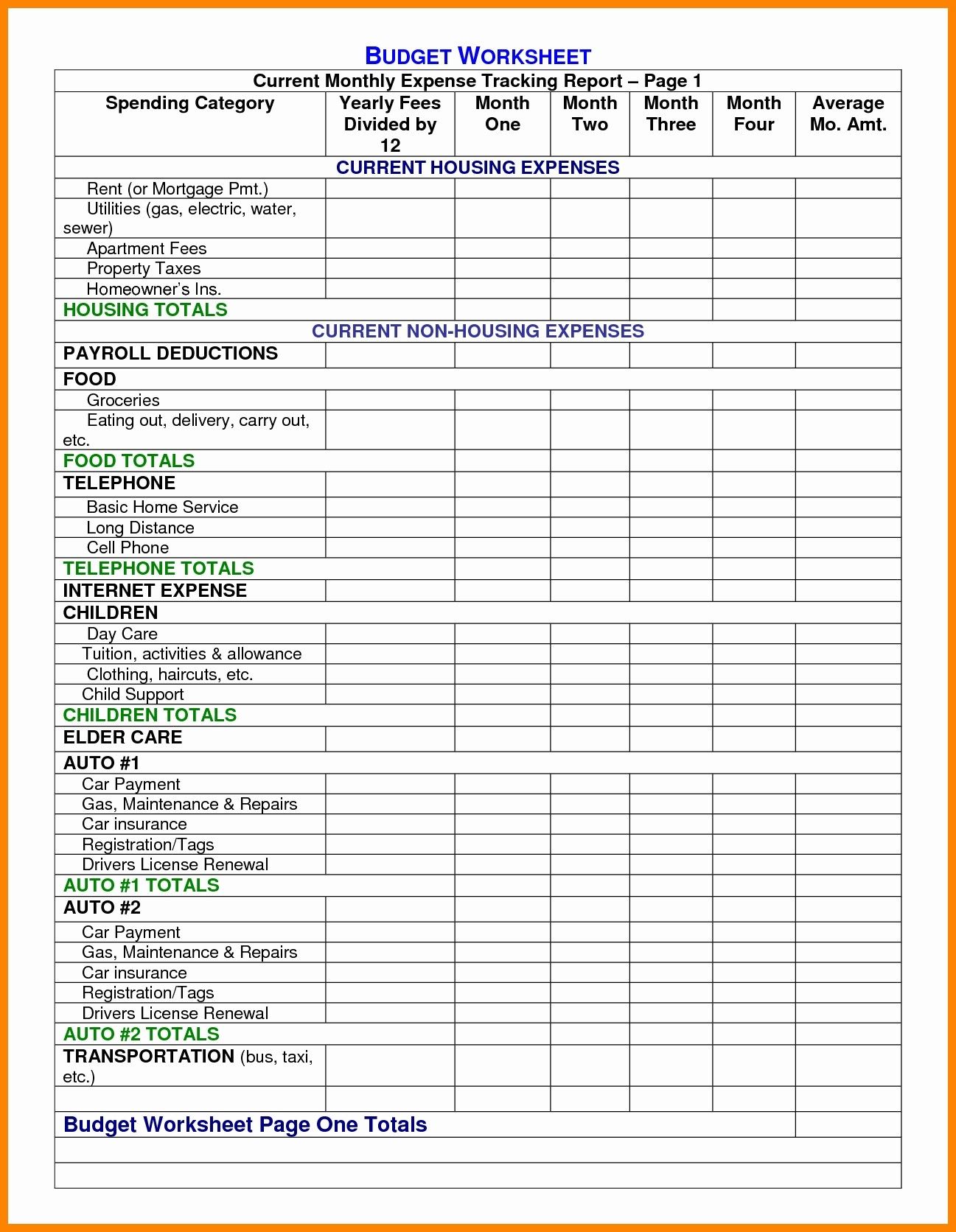

- Easy-to-Follow Layout: The worksheet provides a clear, structured format that makes tracking both income and expenses straightforward.

- Income and Expense Categories: It categorizes income sources like pensions, Social Security, and investments, alongside common expenses such as healthcare, housing, and leisure.

- Adjustable: You can adjust the categories to better fit your personal situation.

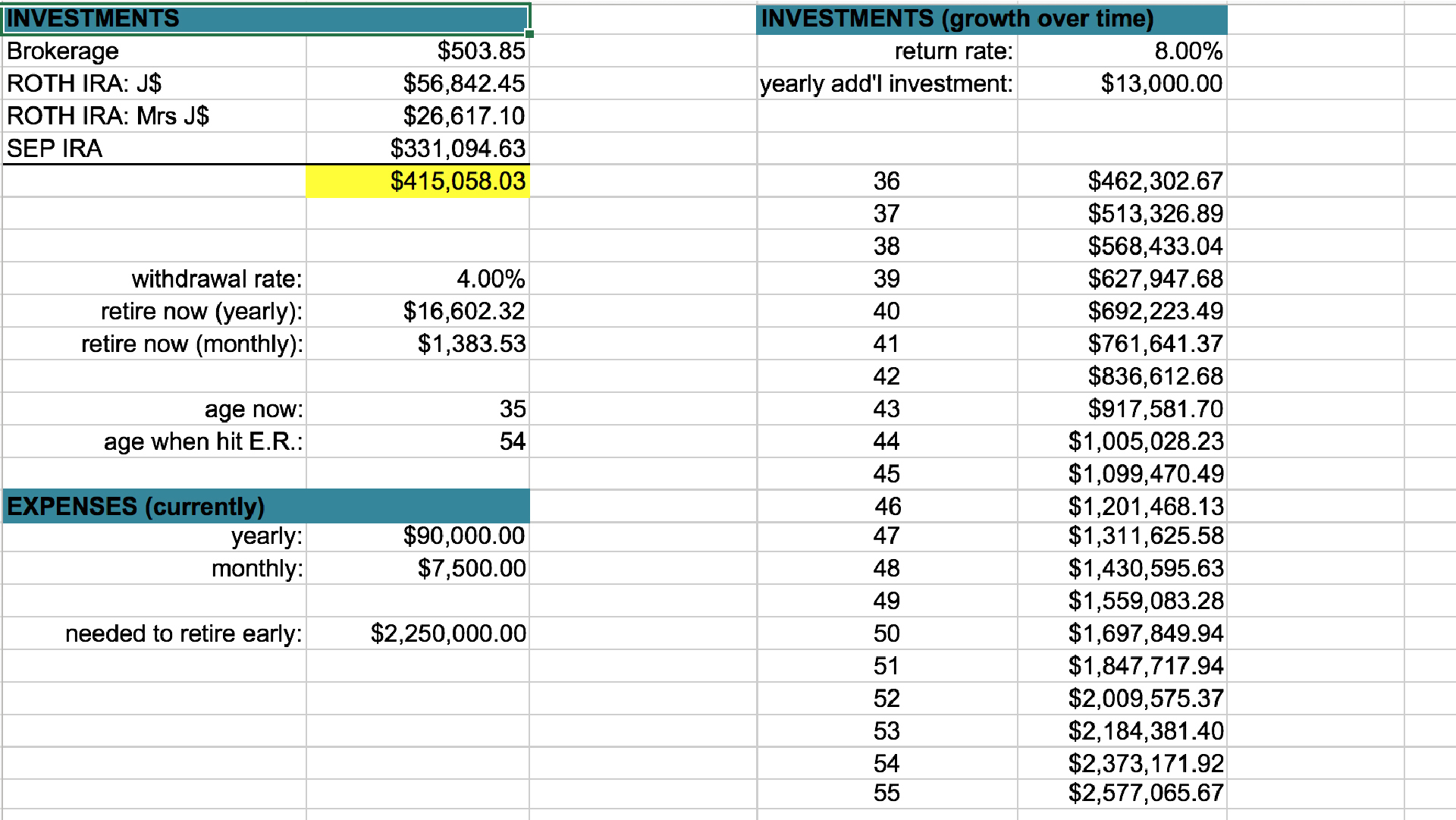

- Financial Planning Aid: Beyond tracking, it aids in creating a financial plan for the future, helping you identify areas where you might need to save or invest more.

How to Use the AARP Budget Worksheet

To make the most of the AARP Budget Worksheet, follow these steps:

Gather Your Financial Data

First, collect all necessary financial documents including bank statements, investment portfolios, bills, and records of any income sources.

Input Your Data

| Step | Description |

|---|---|

| 1. Income | List all your income sources: Social Security, pensions, investment returns, annuities, etc. |

| 2. Expenses | Enter your monthly and annual expenses. These can be fixed (like rent/mortgage) or variable (like groceries). |

Analyze Your Financial Health

- Compare your total income against your total expenses to see if you’re breaking even, living within your means, or if adjustments are necessary.

📌 Note: Remember to account for any irregular income or expenses which might not occur monthly but should be included in your annual budgeting.

Plan for the Future

After assessing your current financial health, use the worksheet to:

- Set financial goals.

- Identify potential areas of savings or where additional income might be needed.

- Consider inflation, healthcare cost increases, and potential changes in your living situation.

Why Use the AARP Budget Worksheet?

The AARP Budget Worksheet is especially tailored for seniors:

- Designed for Clarity: Its structure simplifies the complex task of financial planning, making it easier to understand and maintain.

- Visibility: It provides an at-a-glance overview of your financial situation, which is essential for proactive planning.

- Control: Knowing your financial standing empowers you to make informed decisions regarding expenditures and investments.

- Planning for Healthcare: The worksheet includes specific categories for healthcare costs, which often increase with age.

By regularly updating and reviewing your budget, you can anticipate financial needs well in advance, securing your financial future and ensuring a comfortable retirement.

Customizing the Worksheet

Here are some tips to personalize your AARP Budget Worksheet:

- Create Subcategories: If you find a single category too broad (like entertainment), break it down into music, movies, dining out, etc.

- Add Personal Goals: Include sections for one-time expenses like travel, major purchases, or home renovations.

- Adjust Frequency: Change the frequency of tracking to monthly, quarterly, or annually to better match your financial cycle.

To sum it up, the AARP Budget Worksheet is a powerful tool for seniors looking to simplify their financial planning. By providing a structured format to monitor income and expenses, it not only brings clarity to your financial life but also empowers you to make strategic decisions for your future. Whether you're considering retirement or already enjoying it, this worksheet can help you stay financially secure and enjoy peace of mind.

Can I use the AARP Budget Worksheet if I’m not a member?

+

Yes, the worksheet is available for everyone to use, regardless of AARP membership status. However, AARP members might receive additional resources or support.

How often should I update my budget?

+

Monthly updates are ideal to reflect your current financial situation, but annual reviews are essential for planning for the future.

What if my expenses exceed my income?

+

Consider reducing expenses, increasing income sources, or seeking financial advice to ensure sustainability. The worksheet can help identify where adjustments are needed.