5 Essential Tips for Completing Your 941 ERTC Worksheet

Managing your business's payroll and adhering to the Internal Revenue Service's (IRS) regulations can be a complex task. One of the more intricate forms you might encounter is the Form 941, the Employer’s Quarterly Federal Tax Return. This document is crucial for reporting payroll taxes, but with recent changes to the Employee Retention Credit (ERC), it's vital to complete the associated 941 ERTC worksheet correctly. Here are five essential tips to help you navigate and complete your 941 ERTC worksheet effectively.

1. Understand the Eligibility Criteria for ERTC

The Employee Retention Credit (ERTC) was introduced to help businesses retain employees during tough economic times, specifically during the COVID-19 crisis. Here’s what you need to know:

- Qualified Employers: Businesses or tax-exempt organizations that have been subject to governmental orders to fully or partially suspend operations or have experienced a significant decline in gross receipts.

- Wages Eligible for Credit: Wages paid to employees, which includes health plan expenses, are generally eligible. However, there are limitations if the business had a Paycheck Protection Program (PPP) loan or received certain other credits.

- Credit Amount: For 2020, the credit equals 50% of qualifying wages, up to 10,000 per employee, for the entire year. For 2021, the credit increased to 70% of qualified wages up to 10,000 per quarter, per employee.

📌 Note: Ensure you review the IRS guidelines for the most current eligibility requirements and credit calculations as these can change.

2. Gather All Necessary Information

Before starting your 941 ERTC worksheet, ensure you have the following documents and information at hand:

- Payroll records detailing wages, health plan expenses, and the qualifying employees.

- Documentation showing government orders for partial or full suspension of operations or your significant decline in gross receipts.

- Previous Form 941 submissions to adjust or reconcile the credit calculations.

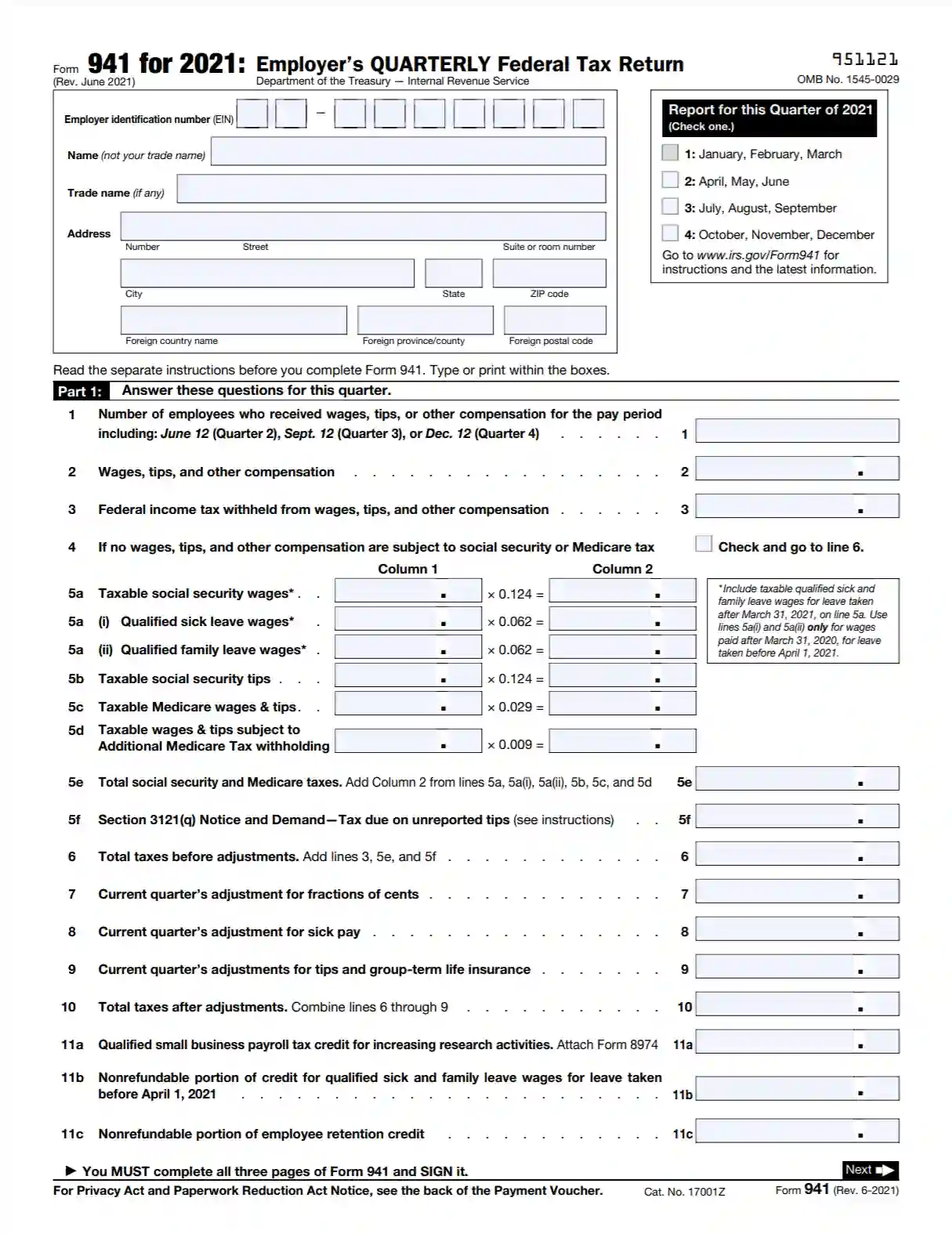

3. Fill Out the Worksheet Accurately

The 941 ERTC worksheet is integral to accurately claiming your ERTC. Here’s how to proceed:

- Step 1: Determine the qualified wages. This should include wages and health plan expenses paid to eligible employees.

- Step 2: Calculate the credit amount. Use the applicable credit rate (50% for 2020 or 70% for 2021) on the wages paid to each qualifying employee, up to the specified limit.

- Step 3: Complete the worksheet to determine the credit amount that can be applied against the employer’s share of Social Security taxes.

| Step | Action |

|---|---|

| 1 | Identify qualifying wages and health plan expenses. |

| 2 | Calculate the credit on those wages at the appropriate rate. |

| 3 | Enter the total credit on the Form 941 line 11c. |

📌 Note: There might be cases where you'll need to amend previous returns to claim the ERTC; ensure you understand the implications and process.

4. Double-Check All Calculations

Accurate calculations are fundamental:

- Recalculate the ERTC for each quarter you’re claiming, ensuring you account for the correct percentage of wages.

- Verify that the credit does not exceed your tax liability, as the ERTC cannot exceed the employer’s share of Social Security taxes for that period.

- Ensure you’re not double-dipping by claiming the same wages for both ERTC and PPP loan forgiveness.

5. Stay Updated with IRS Announcements and Guidance

The IRS regularly updates its guidance on the ERTC:

- Monitor IRS updates on ERTC changes, including any retroactive adjustments or extensions to the credit.

- Be aware of deadlines for claiming the ERTC to avoid missed opportunities for savings.

📌 Note: Keep in mind the IRS has provided safe harbor rules for certain issues with ERTC eligibility and calculations, which might be beneficial if your situation is close to the line of qualification.

Completing the 941 ERTC worksheet demands precision, attention to detail, and an understanding of ever-evolving tax laws. By understanding the eligibility, gathering your documents, filling out the worksheet accurately, double-checking your calculations, and staying updated with IRS announcements, you can navigate this process with confidence. Taking these steps not only ensures compliance but also maximizes the financial benefits your business might be eligible for during these challenging economic times.

Can I claim ERTC if I received a PPP loan?

+

Yes, with the introduction of the Consolidated Appropriations Act of 2021, businesses can now apply the ERTC to wages not claimed for PPP forgiveness.

What counts as a significant decline in gross receipts?

+

A significant decline is defined as a drop of more than 50% for any 2020 calendar quarter compared to the same quarter in 2019.

How do I know if my business operations were suspended?

+

Business operations are considered suspended if your business was fully or partially shut down by a federal, state, or local government order due to the COVID-19 crisis.