5 Ways to Convert 33000 Pounds to Dollars

Understanding Currency Conversion

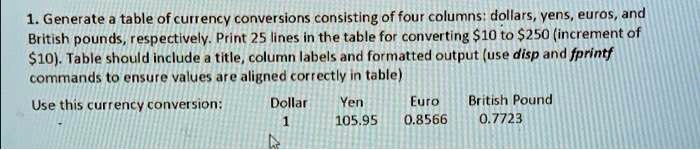

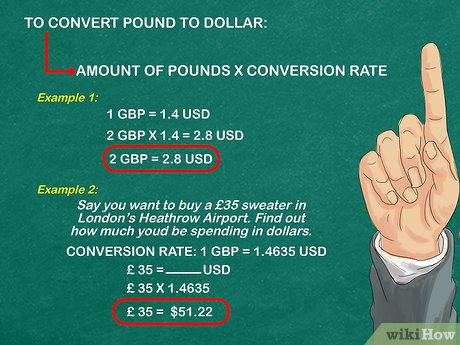

Converting currencies can be a daunting task, especially when dealing with large amounts like 33,000 pounds. The exchange rate between the British Pound (GBP) and the United States Dollar (USD) fluctuates constantly, so it’s essential to stay up-to-date with the latest rates. In this article, we will explore five ways to convert 33,000 pounds to dollars, including online conversion tools, financial institutions, and more.

Method 1: Online Currency Conversion Tools

One of the easiest ways to convert 33,000 pounds to dollars is by using online currency conversion tools. There are many websites and apps available that offer real-time exchange rates and conversion calculators. Some popular options include:

- XE.com

- Oanda.com

- Google Currency Converter

These tools allow you to enter the amount you want to convert (in this case, 33,000 pounds) and the desired currency (US dollars). They will then provide you with the current exchange rate and the converted amount.

💡 Note: Keep in mind that online conversion tools may not always reflect the exact exchange rate you'll get from a financial institution, as they often include margins and fees.

Method 2: Financial Institutions

Another way to convert 33,000 pounds to dollars is by visiting a financial institution such as a bank or currency exchange office. These institutions typically offer competitive exchange rates and can handle large transactions. Some popular financial institutions include:

- HSBC

- Barclays

- Western Union

When using a financial institution, you’ll need to provide identification and proof of address. They will then guide you through the conversion process and provide you with the exchanged amount.

📝 Note: Be aware that financial institutions often charge fees and commissions for currency conversions, which can eat into your exchanged amount.

Method 3: Currency Exchange Offices

Currency exchange offices are specialized businesses that focus on exchanging currencies. They often offer competitive exchange rates and lower fees compared to financial institutions. Some popular currency exchange offices include:

- Travelex

- Moneycorp

- Currencies Direct

When using a currency exchange office, you’ll need to provide identification and proof of address. They will then guide you through the conversion process and provide you with the exchanged amount.

💸 Note: Be sure to compare rates and fees among different currency exchange offices to get the best deal.

Method 4: ATMs and Debit/Credit Cards

If you’re traveling abroad, you can also use ATMs or debit/credit cards to convert 33,000 pounds to dollars. Many ATMs and cards offer competitive exchange rates and low fees. However, be aware that you may be charged:

- ATM fees

- Foreign transaction fees

- Interest charges (if using a credit card)

Some popular debit/credit cards for international transactions include:

- Revolut

- TransferWise

- Mastercard

🚫 Note: Be cautious when using ATMs and debit/credit cards abroad, as you may be charged high fees and poor exchange rates.

Method 5: Specialist Currency Brokers

Specialist currency brokers are experts in international currency transactions. They often offer competitive exchange rates and low fees, making them a great option for large transactions. Some popular specialist currency brokers include:

- Currencies Direct

- TorFX

- WorldFirst

When using a specialist currency broker, you’ll need to provide identification and proof of address. They will then guide you through the conversion process and provide you with the exchanged amount.

📊 Note: Be sure to research and compare rates among different specialist currency brokers to get the best deal.

| Method | Pros | Cons |

|---|---|---|

| Online Currency Conversion Tools | Convenient, fast, and easy to use | May not reflect exact exchange rates, includes margins and fees |

| Financial Institutions | Competitive exchange rates, secure transactions | Charges fees and commissions, requires identification and proof of address |

| Currency Exchange Offices | Competitive exchange rates, lower fees compared to financial institutions | May have limited locations, requires identification and proof of address |

| ATMs and Debit/Credit Cards | Convenient, fast, and easy to use | Charges ATM fees, foreign transaction fees, and interest charges |

| Specialist Currency Brokers | Competitive exchange rates, low fees, expert advice | Requires identification and proof of address, may have limited locations |

In conclusion, converting 33,000 pounds to dollars can be done through various methods, each with its pros and cons. By understanding the different options available, you can make an informed decision and get the best exchange rate for your needs.

What is the current exchange rate between GBP and USD?

+

The current exchange rate between GBP and USD fluctuates constantly. You can check the latest rate using online currency conversion tools or by visiting a financial institution.

Which method is the cheapest for converting 33,000 pounds to dollars?

+

The cheapest method for converting 33,000 pounds to dollars depends on the current exchange rate and fees associated with each method. Specialist currency brokers and online currency conversion tools often offer competitive exchange rates and low fees.

Can I convert 33,000 pounds to dollars using a credit card?

+

Yes, you can convert 33,000 pounds to dollars using a credit card. However, be aware that you may be charged high fees, interest charges, and poor exchange rates.