2024 Eaton Payroll Worksheet Simplified on Google Sheets

Managing payroll can be an intricate dance of numbers, especially when adhering to the latest updates and changes in employment legislation. For businesses aiming for efficiency without missing a step, using the 2024 Eaton Payroll Worksheet in Google Sheets is an excellent choice. Here’s your complete guide to mastering it and ensuring your payroll is as accurate as it is compliant.

Why Choose the 2024 Eaton Payroll Worksheet?

The Eaton Payroll Worksheet is renowned for its user-friendly interface and comprehensive approach to payroll management. By integrating this tool with Google Sheets, you benefit from:

- Cloud Access: Manage payroll from anywhere at any time.

- Real-Time Updates: Seamless integration with Google Workspace ensures your data is current.

- Collaboration: Share the worksheet with your team for collaborative work or review.

- Cost-Efficiency: Avoid the overhead costs of payroll software while maintaining functionality.

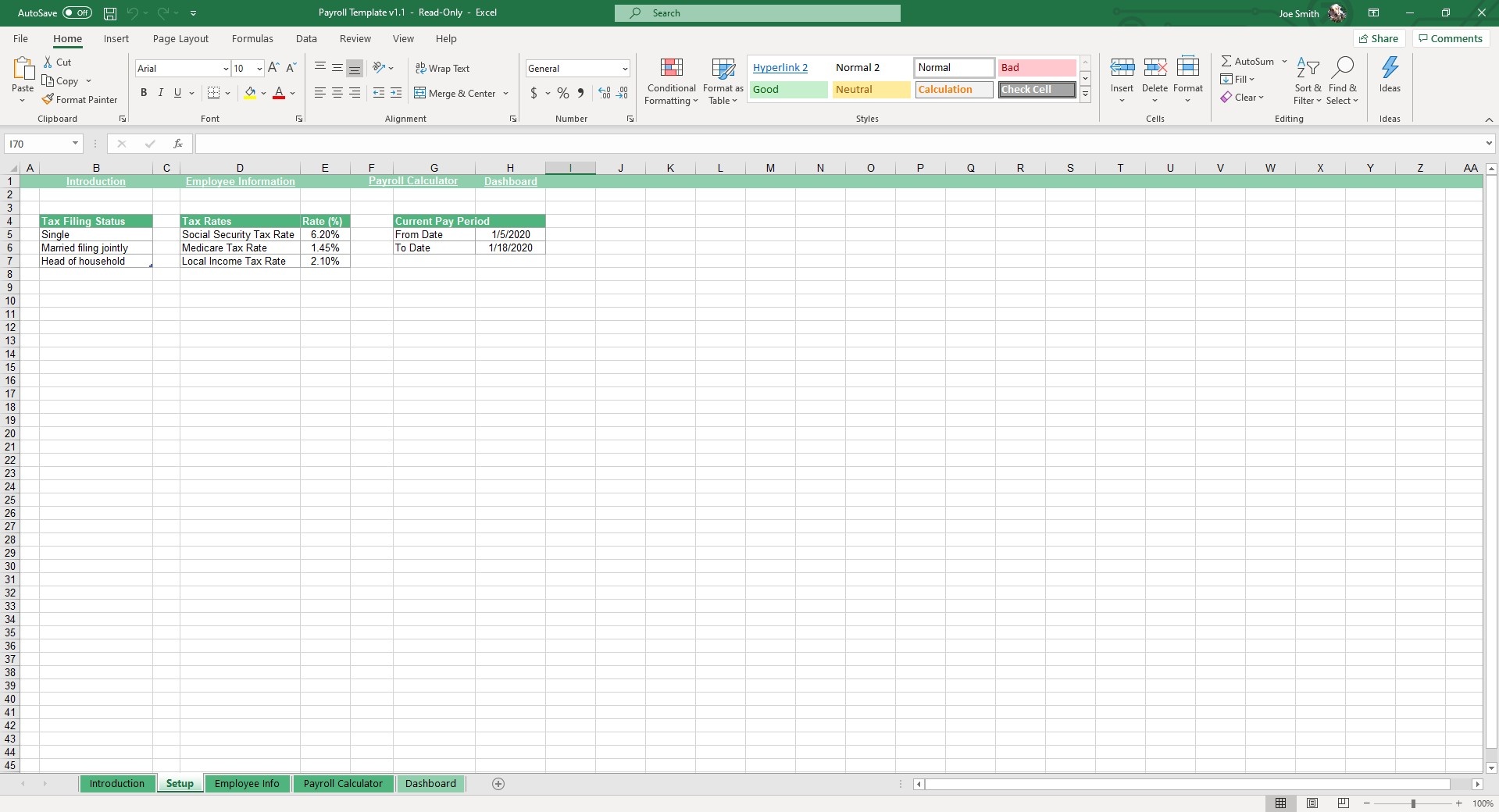

Setting Up Your Workspace

Before diving into the payroll calculations, let’s prepare the Google Sheets environment:

- New Spreadsheet: Open Google Sheets and create a new spreadsheet.

- Name the Sheet: Label it as “2024 Eaton Payroll Worksheet” for easy identification.

- Import Template:

- Search for and download the “2024 Eaton Payroll Worksheet” template.

- Import this template into your Google Sheets by selecting File > Import and choosing the downloaded template.

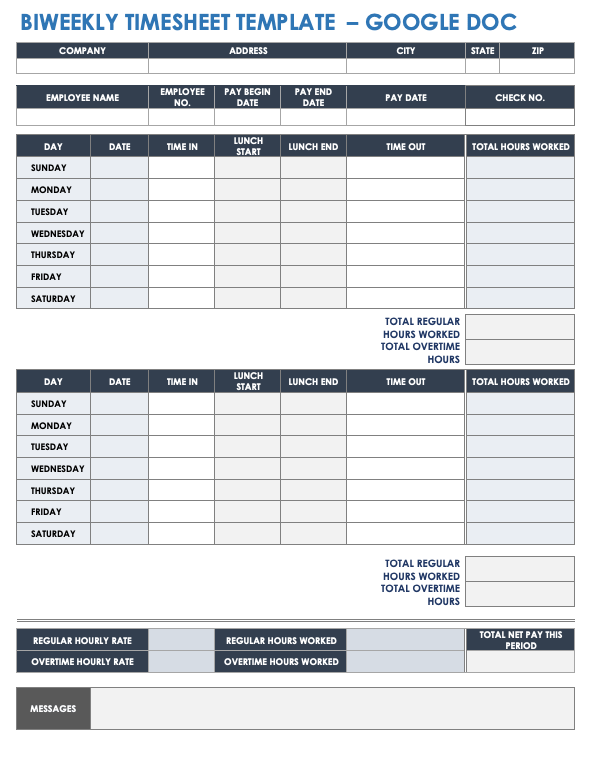

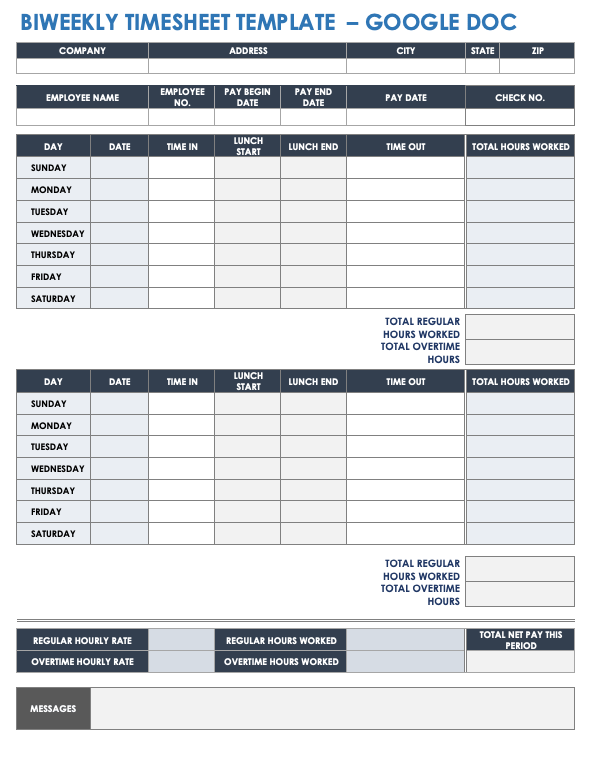

Understanding the Worksheet Components

The Eaton Payroll Worksheet is divided into several critical sections:

- Employee Information: Here, you’ll enter basic employee details.

- Payroll Period: This section helps you manage different payroll cycles.

- Pay Rate & Hours: Compute regular and overtime hours.

- Deductions: List and calculate all mandatory and voluntary deductions.

- Net Pay: Where you’ll see the actual take-home pay for each employee.

🔍 Note: Always double-check the payroll period for accuracy to ensure proper calculations.

Key Steps for Accurate Payroll

- Enter Employee Information: Include full names, employee IDs, and relevant personal details.

- Select Payroll Period: Choose the correct period to compute the pay for. This could be weekly, bi-weekly, or monthly.

- Record Hours: Fill in the hours worked, distinguishing between regular and overtime.

- Input Pay Rates: Enter each employee’s rate, ensuring it’s up-to-date for the current year.

- Deductions: Calculate deductions such as Social Security, Medicare, federal, and state taxes. You may also include other deductions like health insurance or 401k contributions.

- Compute Net Pay: After entering all necessary data, the worksheet should automatically calculate the net pay.

| Field | Description |

|---|---|

| Name | Employee's full name |

| Employee ID | Unique ID for each employee |

| Hours Worked | Total hours in the payroll period |

| Pay Rate | Hourly wage or salary amount |

| Deductions | List of deductions to be withheld |

| Net Pay | Employee's take-home pay |

Regular Updates and Compliance

Payroll isn’t static; it requires regular updates to stay compliant:

- Annual Adjustments: Ensure federal and state tax rates are updated each year.

- New Tax Tables: Implement changes in tax tables to accurately calculate withholdings.

- Benefits and Contributions: Review and adjust employee benefits contributions annually.

Benefits of Using Google Sheets for Payroll

Google Sheets offers several advantages for payroll:

- Scalability: Manage payroll for small to large teams seamlessly.

- Formula Integration: Utilize built-in functions for calculations and data analysis.

- Version Control: Keep a history of all changes made to the payroll sheet.

- Security: Google Sheets employs robust security measures, protecting your data.

To wrap up, the 2024 Eaton Payroll Worksheet in Google Sheets is an invaluable tool for businesses seeking to streamline payroll processes. By following the steps outlined, you ensure that your payroll is not only precise but also in line with the latest regulatory requirements. Remember, accuracy in payroll not only keeps your finances in order but also promotes a positive work environment where employees feel fairly compensated for their work.

Can I use the Eaton Payroll Worksheet for multi-state employees?

+

Yes, the worksheet allows you to input different state tax rates, ensuring accurate calculations for employees across various states.

Is there a mobile app for managing payroll using Google Sheets?

+

Google Sheets itself doesn’t have a dedicated payroll app, but you can access and edit sheets through the Google Sheets mobile app or the Google Drive app.

How often should I update my payroll worksheet?

+

Regular updates should be done annually or whenever there are significant changes in tax laws, employee benefits, or company policies.