Fun 1st Grade Money Worksheets for Kids

Understanding money and basic financial concepts early in life can lay the groundwork for lifelong financial literacy. That's where 1st grade money worksheets become invaluable educational tools. These worksheets are crafted to introduce young learners to counting coins, recognizing different denominations, and performing basic financial transactions in a way that's not only educational but also fun. Let's delve into how these engaging resources can make learning about money an exciting part of a child's first-grade experience.

The Basics of Money for First Graders

Before diving into complex calculations, first graders need to grasp the basic concepts of money:

- Coin and Bill Recognition: Identifying different types of coins and bills is the foundation. Use images of pennies, nickels, dimes, quarters, and perhaps even dollars to familiarize children with these symbols of currency.

- Understanding Value: Children need to know that different coins have different values. This can be taught through activities where they match coins to their equivalent values.

- Making Change: While they might not need to calculate exact change, understanding that smaller coins can make up larger amounts is beneficial.

Interactive Money Worksheets

Money worksheets at the 1st grade level should be visually appealing and interactive:

- Coloring Sheets: Give children worksheets where they color different coins according to their value. This not only helps with coin recognition but also reinforces the concept of value.

- Counting Games: Develop worksheets with games where children count coins to purchase items with specific price tags. Use pictures or real-life scenarios to keep the activity engaging.

- Matching Activities: Create worksheets where students match pictures of coins to their written values or vice versa. This can also extend to bills.

- Story Problems: Incorporate simple story problems that involve spending money, like ‘John has 5 dimes. How many cents does he have?’

Why Money Worksheets Matter

Here are several reasons why introducing children to money management through worksheets is crucial:

- Early Math Skills: Working with money helps reinforce addition, subtraction, and basic arithmetic in a real-world context.

- Financial Literacy: Understanding money at a young age encourages responsible financial behavior later in life.

- Practical Applications: Children learn to apply math concepts to everyday scenarios, enhancing their problem-solving abilities.

Designing Effective Money Worksheets

When creating or selecting money worksheets for first graders, consider the following:

- Simplicity: Keep instructions straightforward with minimal text. Use lots of visual aids like pictures of coins and dollars.

- Repetition and Reinforcement: Make worksheets that allow for repeated practice to solidify the concepts.

- Variety: Introduce different types of activities to keep interest high, like puzzles, mazes, and fill-in-the-blank exercises.

Sample Worksheets

Here are a few sample worksheet ideas you can adapt:

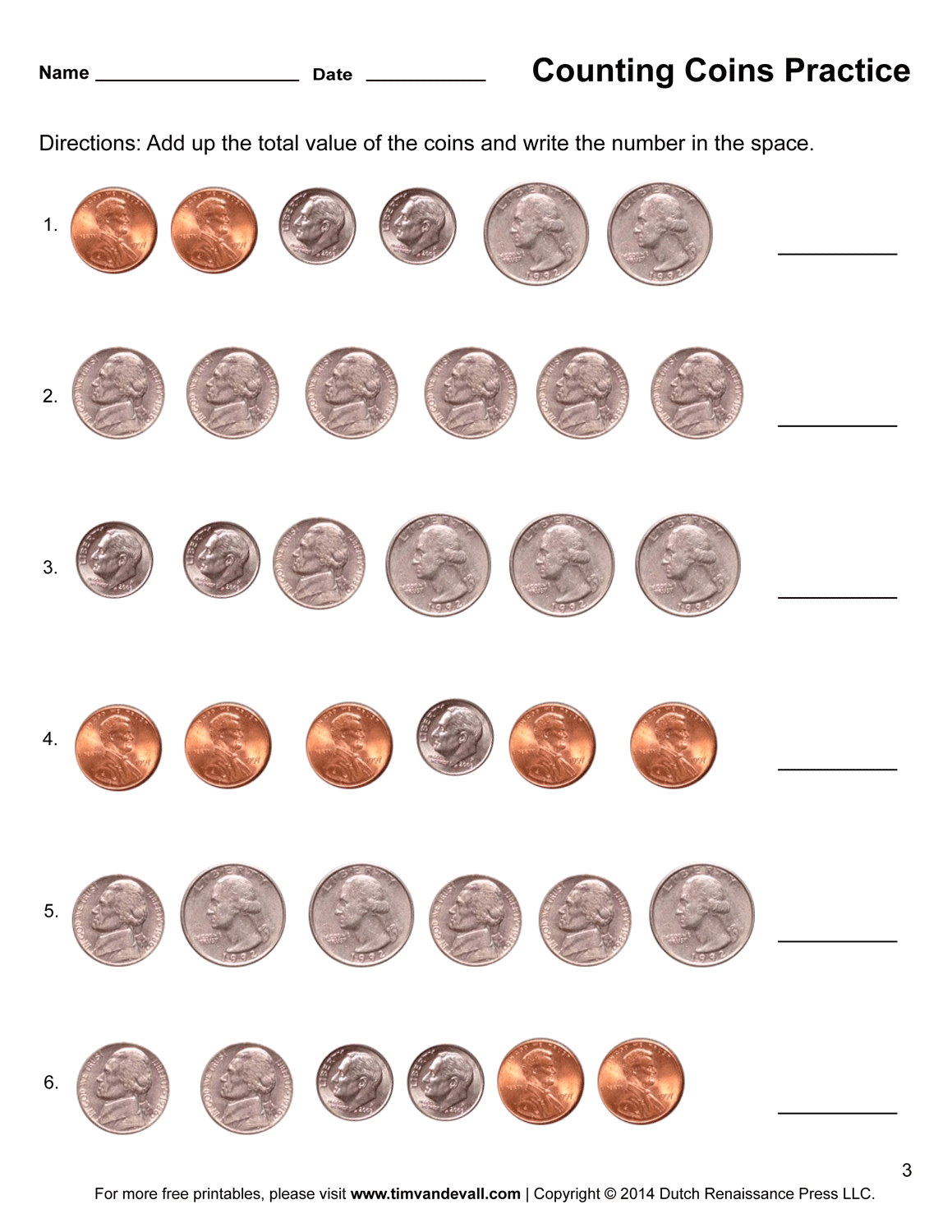

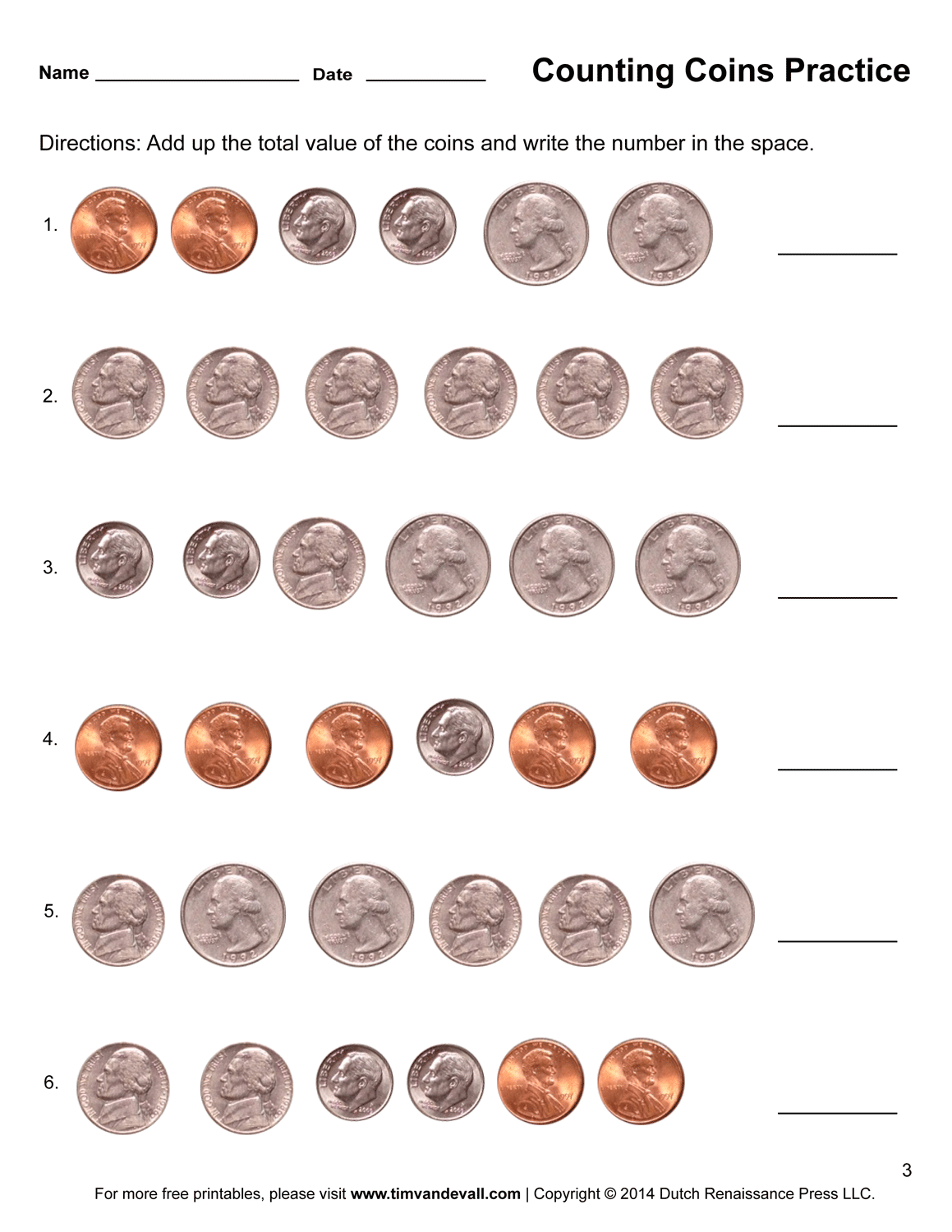

- Count the Coins: Children count the coins on the worksheet and write down the total value. Use images of real coins.

- Coin Match: A grid where students draw lines from pictures of coins to their corresponding values.

- Money Maze: A maze puzzle where they collect coins to reach a goal, keeping a running total along the way.

Integrating Technology

In today’s digital age, using technology to teach money management can be both fun and educational:

- Educational Apps: Look for apps that simulate shopping or simple financial transactions, turning learning into a game.

- Interactive Websites: Websites offer interactive math games where children can count money, make change, and even open virtual savings accounts.

🎲 Note: Be cautious with technology to ensure it supplements, rather than replaces, hands-on learning with real money.

Wrapping Up

Money worksheets for first graders are essential tools in introducing young minds to the world of finance. They blend learning with play, making it easier for children to grasp complex concepts like counting, saving, and spending. By integrating these activities into their curriculum, educators can foster an early understanding of financial literacy, setting children up for a lifetime of responsible money management. As we’ve seen, these worksheets can range from simple recognition exercises to interactive problem-solving activities, all tailored to keep children engaged and learning effectively.

What age group is suited for money worksheets?

+

Children entering the first grade, typically aged 6-7, are well-suited for beginning to explore money concepts with appropriate worksheets.

How often should kids practice with money worksheets?

+

Regular practice, about once or twice a week, helps children to reinforce their understanding without overwhelming them with too much repetition.

Can parents use these worksheets at home?

+

Absolutely! These worksheets are designed to be accessible for both school and home learning environments, offering a fun way for parents to teach money concepts.

Are there digital alternatives to physical money worksheets?

+

Yes, there are many educational apps and websites that provide interactive digital money worksheets, enhancing learning through technology.