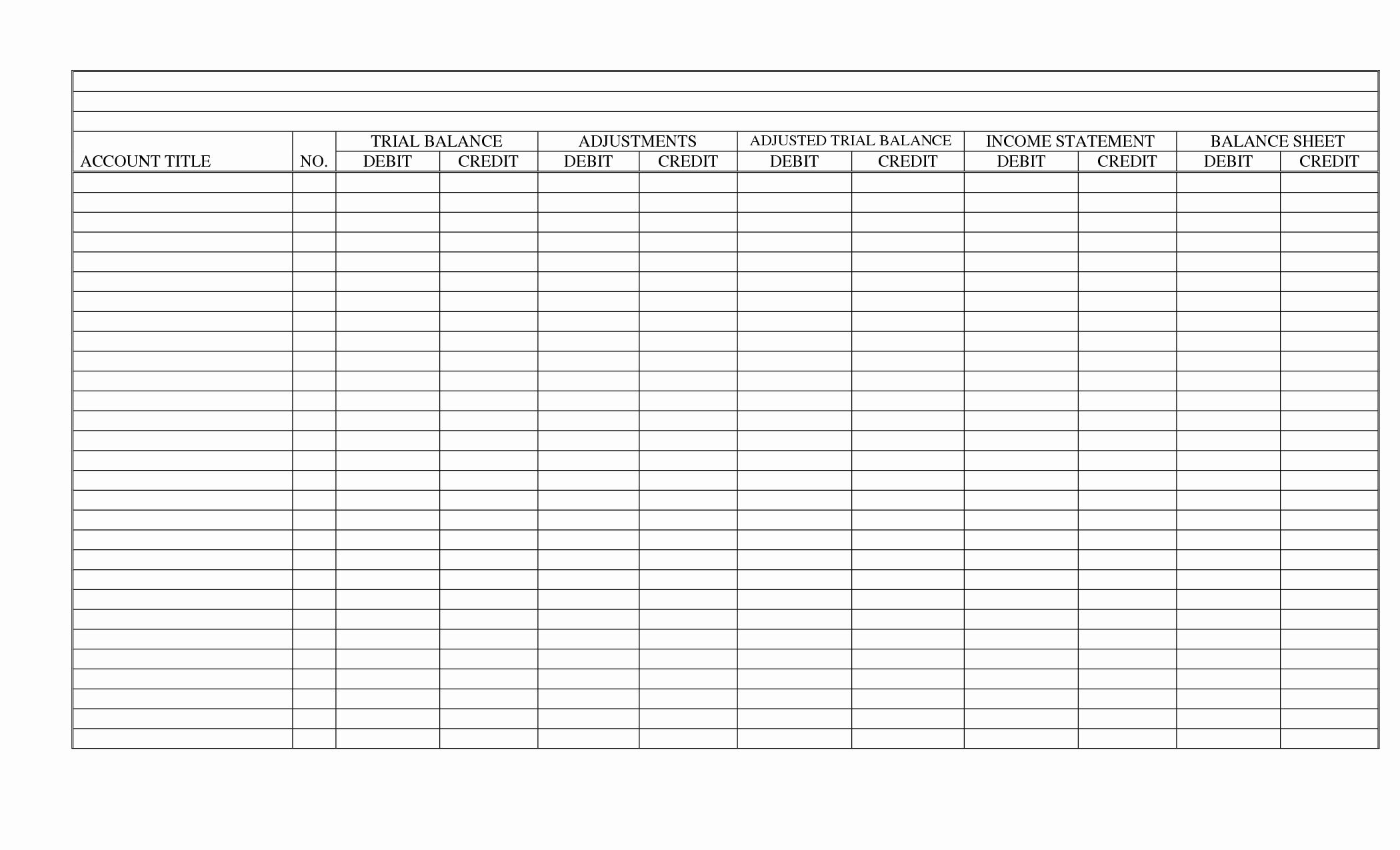

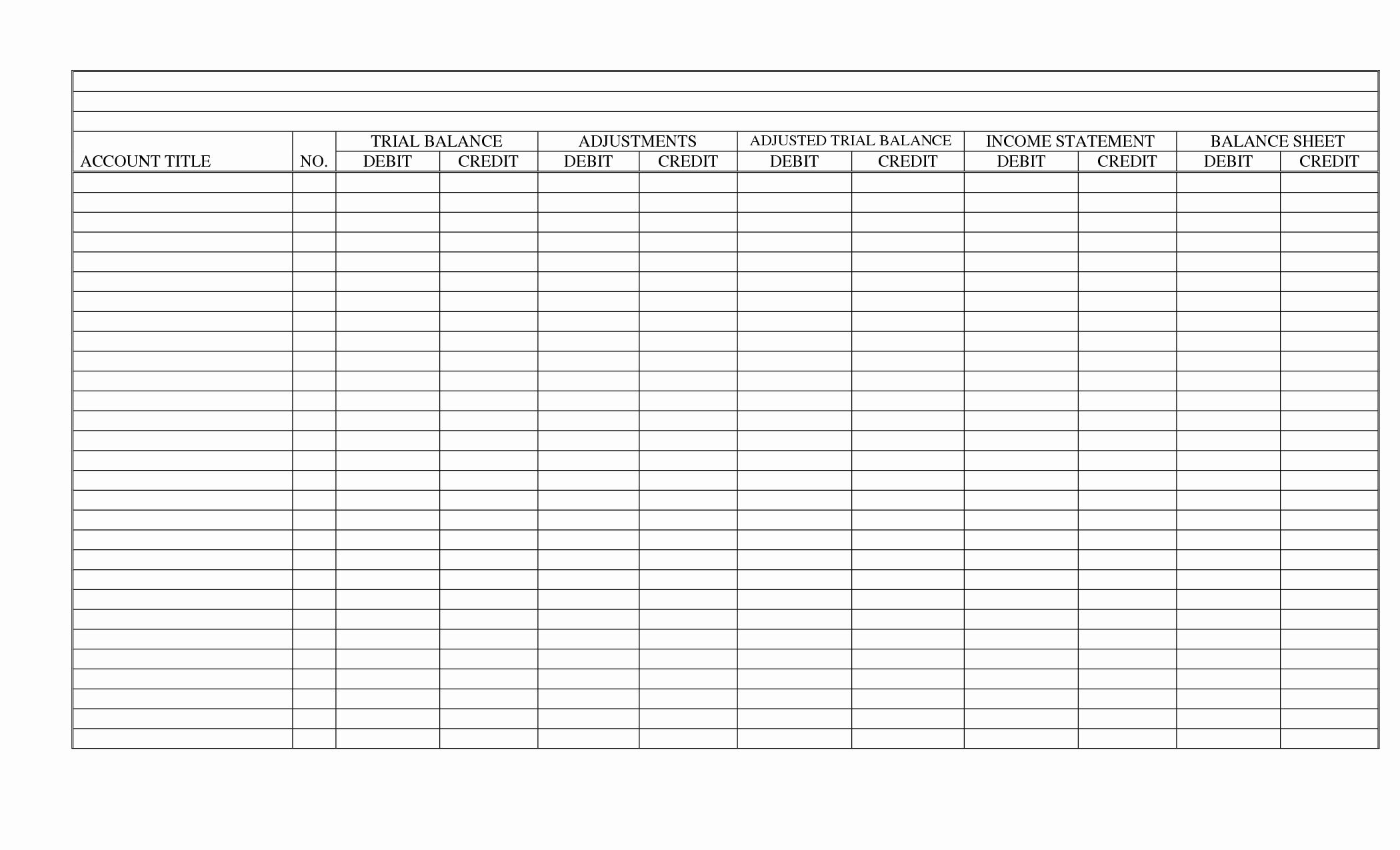

Free 10 Column Worksheet Printable for Easy Budgeting

Creating a budget is often considered a daunting task, but with the right tools, it can be both educational and empowering. A 10-column worksheet printable can serve as an excellent tool for visual learners and those who find traditional budgeting methods a bit cumbersome. This guide will walk you through how to make the most out of a 10-column budget worksheet, enhance your financial literacy, and set you on a path to financial stability.

Why Use a 10-Column Worksheet for Budgeting?

Before diving into the steps, it's essential to understand why the 10-column format is particularly advantageous for budgeting:

- Clarity: Each column serves a distinct purpose, making your financial picture clear at a glance.

- Organization: All your income, expenses, savings, and debt payments are neatly categorized, reducing confusion.

- Flexibility: Easily adjust to track different financial categories or adapt to different time periods.

- Visibility: It highlights where your money goes, helping you spot areas to cut back or where to focus your saving efforts.

Setting Up Your 10-Column Budget Worksheet

Step 1: Download or Print Your Worksheet

Begin by downloading or printing a 10-column worksheet. Numerous websites offer free templates, so you can easily find one that fits your needs. Choose one that provides enough space to write in your income and expenses clearly.

Step 2: Label Your Columns

Here’s how to label each column:

| Column 1 | Description |

|---|---|

| 1 | Income Category |

| 2 | Expected Income |

| 3 | Actual Income |

| 4 | Difference |

| 5 | Fixed Expenses |

| 6 | Variable Expenses |

| 7 | Savings Goals |

| 8 | Debt Payments |

| 9 | Total Outflows |

| 10 | Balance |

Customizing the columns according to your financial situation can help in tracking your money more accurately.

Step 3: List Your Income

Under ‘Income Category’, list all sources of income like salary, freelance earnings, side hustles, investments, etc. Note the expected income for the month in the ‘Expected Income’ column, and when the actual income comes in, fill that in the ‘Actual Income’ column. The ‘Difference’ column will show any discrepancies.

Step 4: Detail Your Expenses

Break down your expenses into fixed and variable:

- Fixed Expenses: rent, mortgage, insurance, subscription services, loan payments.

- Variable Expenses: groceries, dining out, entertainment, utilities, gas.

These should be categorized into the appropriate column, making it easy to see what’s expected versus what’s actually spent.

Step 5: Budget for Savings and Debt

Specify your savings goals in the ‘Savings Goals’ column, which could include emergency funds, retirement accounts, or a vacation fund. For debt, list payments in the ‘Debt Payments’ column, helping you keep track of your repayment progress.

Step 6: Calculate Total Outflows

Sum up all the money going out in the ‘Total Outflows’ column to understand your monthly expenditure.

Step 7: Monitor the Balance

The ‘Balance’ column will show if you’re saving money or if you’re going over your budget. This visual cue can be an eye-opener, motivating you to adjust your spending or seek additional income sources.

Utilizing the Worksheet Over Time

Once your worksheet is set up, here's how you can make the most of it:

Regularly Update Your Worksheet

Track your income and expenses weekly or biweekly. Keeping your worksheet up to date provides real-time feedback on your financial health.

Analyze Your Financial Behavior

Over time, you’ll notice patterns in your spending. Use this insight to make informed financial decisions, such as reducing unnecessary expenses or increasing savings contributions.

Adjust Your Budget as Needed

Life changes, and so should your budget. Adjust the categories, income, and savings goals to reflect any changes in your financial situation.

💡 Note: Regularly reviewing your budget can turn budgeting into a positive experience, helping you feel more in control of your finances.

Final Thoughts

Budgeting with a 10-column worksheet is not just about tracking money; it's about setting financial goals, achieving them, and developing habits that lead to long-term financial stability. By organizing your finances in this structured manner, you gain insights into your spending habits, which can lead to more informed financial decisions. Remember, the goal is not just to save money but to live well within your means and prepare for both expected and unexpected financial events.

The flexibility of this tool allows you to tailor it to your unique financial journey. Whether you're saving for a house, paying off debts, or simply trying to live within your means, this worksheet can adapt to serve your needs. It's a journey of self-awareness and proactive financial management that empowers you to make smarter choices with your money.

How often should I update my 10-column budget worksheet?

+It’s best to update your worksheet at least weekly. This ensures you have a real-time view of your financial situation and can adjust your spending or saving strategies promptly.

Can I use this method if I have variable income?

+Yes, you can. Just ensure you update the ‘Expected Income’ and ‘Actual Income’ columns as your income changes, and adjust your outflows accordingly.

What if I have many sources of income or expenses?

+This is where the 10-column format shines. You can split complex categories into sub-categories or use multiple lines for different income sources or expense types. Remember, the flexibility is one of its strongest features.

How does this budgeting method help with long-term financial goals?

+By providing a clear visual of your financial behavior over time, you can spot trends, make informed decisions, and plan effectively for the future, be it saving for a down payment, retirement, or other long-term goals.

Do I need to be good at math to use this worksheet?

+No, the worksheet does not require advanced math skills. Basic addition and subtraction are all you need to keep track of your financial flows effectively.